Yesterday, in response to the surging price of petrol the government announced it was immediately cutting fuel excise taxes by 25c per litre as well as discounts for public transport.

The Government will cut 25 cents a litre off fuel for three months as part of a cost of living package aimed at giving Kiwi families immediate relief through the current global energy crisis triggered by the war in Ukraine, Prime Minister Jacinda Ardern announced today.

Fuel excise duties and road user chargers will be reduced by 25 cents each and the price of public transport will be halved as part of a package of measures to reduce transport cost pressures on middle and low income households.

“We cannot control the war in Ukraine nor the continued volatility of fuel prices but we can take steps to reduce the impact on New Zealand families,” Jacinda Ardern said.

“Just as it was our job to get New Zealand through the Covid-19 health crisis it’s also our job to put in place a plan to get us through the global energy crisis too.

“There’s no silver bullet that will fix the cost of living, but we have a plan and are implementing a range of measures that together will help to make a difference.

“The global energy crisis has quickly become acute which is why the Government has stepped in to cut fuel duty. Today’s changes will reduce the cost of filling up a 40 litre tank of petrol by over $11, and for a 60 litre tank, over $17.

“We are also making it cheaper for those who catch a bus or a train. In the long term we need to build greater resilience into our transport system so we are less vulnerable to spikes in the price of petrol, but for now halving the cost public transport will provide some families with an alternative to filling up the tank.

To start with it’s great that the government are providing some relief by reducing public transport fares – and as a percentage fares are dropping by more than the price of petrol. However, the devil in the detail is that this won’t come into force till 1 April to give time for local authorities to change their systems.

Given that public transport usage is way down on what we’ve had in the past and the expected cost of this was only $25-40 million, I do wonder if they shouldn’t have just made the decision to make PT free. Not only would this have made it more attractive, it would have had the added benefit that local authorities could just turn the fare machines off immediately. This combined with other initiatives such as allowing all-door boarding could even help to speed up buses.

The cost of the change also suggests that to make PT free for everyone all year would cost less than the drop in fuel tax for just 3 months

One particular challenge in making the most use of this opportunity is just getting people to use PT again. Many office workers in the city continue to work from home and the government spent much of the time during lockdown last year singling out public transport as something to avoid even when many other activities were allowed or encouraged. Perhaps the government and local authorities should also be running some campaigns to highlight that PT is safe to use.

One thing that did catch my eye about the announcement though was that during the press conference, a number of times Deputy PM and Finance Minister Grant Robertson hinted that this fare drop, or something like it, could be extended or modified in this years budget as part of the government’s response to their Emissions Reduction Plan.

“Further, in the Budget in May, we will progress work to ensure we are not at the whim of international oil prices in future, through greater investment from the Climate Emergency Response Fund. These investments will boost our plans for New Zealand to increase energy security and independence by decarbonising our transport fleet and reducing our reliance on volatile global energy markets.”

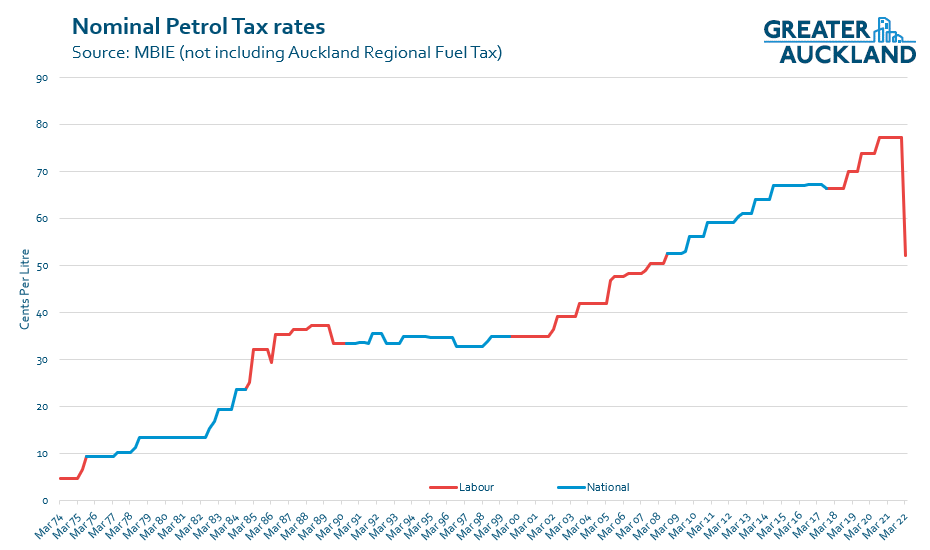

As for the fuel tax cuts, to put the scale of them into perspective, the last time the rate was this low was in early 2009.

The government do say this is a temporary cut and that it will eventually be reversed, but likely only gradually. They also say they’re going to top up the National Land Transport Fund (NLTF) which relies on the revenue from the fuel tax to fund transport projects.

“The estimated cost of this cut over three month period is about $350 million for the fuel tax changes. This will mean reduced revenue for the National Land Transport Fund, which funds our investment in roads and other transport infrastructure. We will be meeting the costs of this through savings and reprioritisation from the COVID Response and Recovery Fund. This means we can continue the Government’s record investment into transport infrastructure without having to cut projects.

“We do need to recognise that petrol prices are expected to continue to rise. The Russian invasion of Ukraine is continuing to undermine and de-stabilise global energy markets and, added to the other inflationary pressures the world has due to COVID supply chain disruptions, this is sadly not over yet.

“That is why we will review the situation over the coming months. We will also outline in the coming days the means by which we will reverse the changes being announced today. It is likely that this will be a gradual phase down in line with global oil prices stabilising and reducing, to keep pressure off families while recognising the need to return to more stable funding for our transport infrastructure.

I can certainly understand why the government have decided to drop the fuel taxes for political reasons. However, by doing so and continuing to build a lot of infrastructure that encourages more driving, including projects that are funded outside the NLTF, it sends a message that the government still aren’t serious in their response to dealing with climate change, and perhaps more worryingly still aren’t ready to have a hard conversation with the public about the need for us to drive less – as their Emissions Reduction Plan calls for.

Processing...

Processing...

Is the Emissions Reduction Plan really still current? I got the impression there was some degree of over-and-above from the Glasgow Conference.

Yes to both. The ERP is current inasmuch as it is the most recent plan. And yes we will be well over the Glasgow goals. I don’t think there was ever any intention of it being otherwise. As the young woman said it was bla bla bla. We won’t even mitigate the 60 tonnes James Shaw generated going there.

6.5T according to online carbon calculators.

Now add on all others he took with him from MfAT, Beef+Lamb and all the rest of his official delegation. He could have used Teams (and he would have been there on the right day).

Given that the government have completely ignored the ‘commitments’ they made there, he may as well have stayed home and not even made the emissions contribution of powering up his computer for a teams call.

Consider that there are few other measures that Government can take rapidly to affect the cost of living where it is currently escalating, and where it is affecting those with lowest incomes. Car dependency comes with poor accessibility and consequent lower housing costs. Also, freight costs affect the price of food and other necessities.

It is difficult to target broad measures to benefit those in need, but this seems to be a fair rapid response and one that can be rapidly adjusted to rapid international changes.

Much harder to tackle, especially rapidly, are the other cost of living inflators. The cost of housing is also rising still. Land market prices and rents are without any visible control. Supply is only slowly cooling those, limited by materials and skilled labour. These matters seem politically very difficult to talk about, let alone act on justly.

Cutting taxes and cutting road construction to reflect the increasing cost of car use would make sense. A big new subsidy for cars does not.

How many decarbonisation opportunities in the form of an international crisis will this government squander?

It takes eschewing Business As Usual mindsets to find the best solution for equity, wellbeing and transport transformation. I don’t see any attempt to do so here.

I don’t think we will. Not from Ardern and Robertson. They’re fundamentally conservative and are not prepared to entertain ideas from outside the status quo.

middle nz dont want mode change

middle nz dont want expensive petrol

Grant and Jacinda want middle NZ

Yes, but good leaders don’t just follow existing patterns. They shape understanding and forge new paths, providing assistance along the way.

International events that help illustrate the need for change should be making this kind of vision-led leadership more natural and easy.

Middle NZ want to have what may soon no-longer be have-able.

Free PT is a good idea. Removing gst off food maybe instead of fuel might be a good idea. Shifting tax from other departments to double down on autopia? Not convinced.

Grocery prices certainly seem cheaper in Australia, part of that must be down to lower gst. Although it “cannot be done” in NZ for some reason.

Probably also has to do with the supermarkets themselves.

Imagine going into a supermarket, and the bread was just $3.50 instead of “HEY IT WAS $4.50 BUT NOW IT IS ONLY 3.50 BUT HURRY UP ONLY TODAY THIS WEEKS SPECIAL ONLY~~!!” And none of this “2 for $7” nonsense either. Supermarkets like that exist overseas. In Europe ALDI always used this kind of no BS pricing as a selling point.

Agreed. The cost differential is not the difference between a 10% GST and one at 15%. Its much bigger than that and lack of competition plays a big role.

Like fuel, market prices for fruit and vegetables are volatile and the GST a fraction of the overall cost.

Could certainly be done. But NZ’s GST is the envy of administrators the world over, because of its lack of carve outs like this and ease of application for business.

Making PT free would rapidly overwhelm the currently-understaffed PT services. Making it half price has the effect of reducing expenses for those who currently use it, which is a good outcome.

Removing GST from ANYTHING is a bad idea; GST admin costs are low precisely because it applies to everything without exceptions. If the government wants to subsidise some products then it should do that as a separate action, perhaps most simply at a supermarket+pharmacy level.

Why do we need to charge GST on food?

There are many in the country wo would be better off having their food taxation treated the same as most other developed nations (i.e. no tax), instead of cheaper transport.

This is not the 1970s, it is quite easy for a computer programme to calculate GST required without human input.

Buy this orange for $40000 and get a car for free! And variations of the same happen as soon as GST is removed from food.

“There are many in the country wo would be better off having their food taxation treated the same as most other developed nations (i.e. no tax), instead of cheaper transport.”

Citation please.

“This is not the 1970s, it is quite easy for a computer programme to calculate GST required without human input.”

Its not the calculation, its the up front determination of what is and is not “food” for GST purposes. And if you think its easy, check out the mountain of VAT litigation over 40yrs in the UK. As someone who worked in the field in Australia, you’d be very surprised at how much uncertainly it throws up for supermarkets and restaurants. Its not all about fresh fruit and veges.

Its such a tiny fraction of the cost of food, obliterated by market impacts in a day, it isn’t worth worrying about.

Politically and economically it is a good move. Apparently according to forecast it will shave half a percent off our rapidly increasing inflation rate. I don’t know how the road user charges will be adjusted that has still to be worked out. I hope there is a similar adjustment for Kiwirail so rail freight is not at a disadvantage. I believe there are track usage payments. It would be good if free HOP cards could be given out to new customers as well as the fare decrease. Hopefully the worst of the current Onmicron wave will be over by the beginning of April which will give people confidence to return to public transport. The Government should have time to come up with a promotional campaign depicting a reset of public transport. I notice the Google map APP gives me car options for sections of my public transport journey. Kiss and ride I suppose. This would be a lot less scarier for people who have never used public transport. So maybe a car sharing first and last mile campaign. And lastly lets think about Intercity travel obviously the Intercity bus operators will get a reduction in road user charges but I wonder if there could be an additional subsidy. There is an awful lot of petrol to be saved if a round trip to drop off a family member or friend can be substituted with a way bus journey.

And that should read “one way journey.”

Prices are supposed to rise and fuel in accordance with supply and demand. If a large chunk of the world’s energy becomes unavailable due to war then the price is supposed to rise. Anything else will prevent people making the appropriate changes in their quantity demanded. Cutting fuel prices is a mistake.

Inflation is a general increase in prices due entirely to too much new money being created. That is what the Reserve Bank did throughout the the pandemic (at times $1billion per week). They did that because the Government added sustainable employment to Monetary Policy Committees goals.

Mmm. Only thing I’d add is that it was a poor ‘reason’. Just as rising fuel prices ultimately lead to deflation by reducing consumption, printing new money doesn’t necessarily serve sustainable employment goals long term, due to all the problems with trickle down economics. So it was really an excuse.

The whole policy response was poor. Economists don’t have a model for pandemics, they didn’t even have a theory. They assumed it would be like a regular recession, but those are usually caused by a financial crisis of some sort. So they reacted with monetary easing when they should have waited to see what would happen. The lock down didn’t kill spending it only deferred it. Tourism losses were offset by people not leaving NZ, and it turns out hospitality doesn’t actually help the economy, money spent boozing got used for better things. I guess we all learned.

Ironic last sentence? We’ll see in time what has been learned, I suppose. To me it feels like we keep trying the same economic policies that were being tried 100 years ago. Maybe we’ll give austerity a go next and trigger a depression, then a war economy, then Keynesian new deal. Or if we have learned anything, we might skip to the end.

You have to be joking.

If you work behind a pc then fine for you, but it was only printing money by the government that protected NZs second biggest earner. I work in this industry and have watched thousands of colleagues across NZ and the world suffer.

If you mean by foreign exchange earnings then that is tourism, but that industry makes a small contribution to GDP because you have to subtract off a similar level of losses due to people travelling overseas. I think second in GDP is construction and they have all done very well thank you. All the extra money people had from not travelling and not wasting it on consumption has been invested and that resulted in a construction boom.

It turns out we can do quite well without tourism, it adds a lot of costs to our country and while it employs a lot of people, they are mostly on very low wages. We would be better off retraining most into more productive areas. Proof of that is that GDP hasn’t tanked and we got rid of it almost completely.

If this is supposed to be about easing the cost of living crisis, why not just give every single person in New Zealand $70 instead of removing the fuel tax? it would cost the same, and still encourage people to avoid fossil fuel use which takes money out of New Zealand and ruins the environment.

You can’t fight inflation by adding more money to the system. It would only work if the $70 was paid for by a new tax on those who are gaining from inflation so it was a transfer. You would need to tax people with big debts and people with real assets. Both are politically hard.

But as you say we should be reducing fossil fuel use and cutting its price isn’t smart.

I’m with you on that, throwing more money into the system doesn’t help with inflation and cutting fuel tax is one of the worst ways to do it.

There’s nothing like lumping general budget money into the NLTF and forging ahead with a heap of super low BCR, high cost roads, in the middle of a global fuel shock.

As a side note cant wait to see what the NZTA use to get round the planned 20% drop in VKT in their business cases for SH capacity building. Will it be spiderman meme material pointing at local authorities? And a double side note, can kiwirail jump at the opportunity of high fuel prices?

What about subsidising ebikes and pushing out a rapid response set of protected cycle lanes on arterial roads? No? Too radical?

Heck, if I could get from Takanini to the city safely I’d pay for the e-bike myself!

I hope you are taking an electric train to get to the city from Takanini. And don’t moan because the price of the fare is about to halve.

I do indeed take the electric train. I’m certainly not moaning about the fare reduction! I would love the flexibility of having a safe bike route though. At the moment the only protected local route is along the motorway from Takanini to Papakura, which doesn’t really take me where I need to go.

Good to hear your on the train maybe a protected bike way to Takanini station would be more appropriate than one to the city centre. Still some more shared paths along Great South Road would be good. Its quite good between the Superclinic and Manukau City.

This will be another opportunity to consider the impacts of Waiheke and Devonport being outside of the Public Transport Operating Model (PTOM), because I’m sure Waiheke ferry fares won’t be reduced in line with other public transport. Phil Goff has so far got away with just postponing discussions on this (because: Covid). Now he’ll come under pressure again. Maybe now he’s retiring he can find some cojones.

The ferry issue will also complicate the half fare rollout. Hopefully, after the $20 daily cap introduction, the ferry fares to Waiheke etc are ringfenced off and won’t hold up the half fare offer.

Only PT with a cost-sharing arrangements with NZTA are covered by the half price fare deal. It would be interesting to know how many services nationwide are in this category.

The fuel tax reduction was necessary for political reasons, it was a definite point of vulnerabilty that was being exploited by other political parties. However, the halving of PT fares is a radical move by NZ standards, a reasonable compromise between affordability while retaining some cost barriers to undesirables.

Absolutely right, Zippo. A politically expedient move embedded in the current governments reactionary conservatism. So when the Nats rollout ThinkBigII as their means of energy independence are we going to see Labour also sign up for mirages like Green Hydrogen, Solar Towers, mini Fission reactors and all sorts of other crank vapourware while they walk right by more solar, more wind, ebikes, cycle ways and other existing, proven and instantly implemenatable solutions?

Nothing like a shift in the polls to get things done! Obviously it is a purely political move as above all else Jacinda and Grant are career politicians and will do and say anything to keep themselves in power. Despite climate change being her “nuclear free moment”. Remember she “has always said that” ….{add response to any question here were the government has changed its mind on something}.

Anyway happy to have the petrol price back to what it was 2 weeks ago. It will still climb to high $3 minimum so will be interesting to see if any further cuts.

I guess we have to wait for the next poll result to see.

Yeah, I haven’t filled up my car since January and petrol was more than 25c cheaper then. I’m hoping the PT move is more permanent, and that there is a radical turnaround in the transport funding.

We eagerly await the opposition parties’ proposals to stop global conflict and covid, and make housing, food, education and health affordable for those on low income – followed by government action. As long as they don’t just say “stop taxing the rich”.

Even with the tax cut, petrol prices are still at record levels… and at the level that definitely puts a lot of people off driving/reducing their driving.

Permanently reducing PT fares is a great decision. Do we know how exactly they are doing this? Are they simply bumping up the government portion to make farebox recovery 25% rather than 50%?

Yes, it’s good to point out there’ll be an effect on demand anyway. And the more attractive the alternatives are – eg with cheaper fares – the more effect the high prices will have.

I wonder if the half-fare PT initiative will include the TranzAlpine train, the sole surviving remnant of KiwiRail’s long distance passenger service? Or is this now classed as a ‘tourist service’ instead of public transport, thereby dodging out of this initiative?

Perhaps there’s a pathway to better regional transport in this, though, Dave. This is a hopeful tweet: https://twitter.com/NicolaPatrickNZ/status/1503292957176516609?t=DoCWF6MannUgCjoCe5wJBg&s=09

More support for buses should lead to more support for trains, and vice versa, as they are complementary. Here’s what the elected members asked for last year:

https://docs.google.com/document/d/15_dFJixh7PgyarWNpXsc872lS3XAIMruzyb9JpWaGeM/edit?pli=1

Did the minister reply to the letter.

The links I click on just show the open letter shouldn’t there be an open reply from a transparent Govt.

Thanks Heidi. Good to see people ‘reminding’ Ministers of what is in their policy statements. Would be nice to see what reply this person received.

Fuel tax drop – Absurd.

Vehicle drivers are already heavily subsidised and cross subsidised.

Is the roading program going to be reduced or the taxpayer cross subsidise the fuel excise tax cut?

Reduced PT fares – one would need to do a complete social cost benefit assessment to determine the appropriate fare levels given the need to provide transport for those without alternatives. There are bigger issues as well like network coverage and frequency.

to any mayoral candidates who (can) read GreaterAuckland

you’ll get my vote if

* Free Public Transport – save a fortune on payment infrastructure

* Active Transport from Northshore to City via the bridge

* AT Ferry services in both Aucklands Harbours

simple really

How much does someone like AT spend on fare gates, enforcement, ticket machines annually that would be saved if there were no fares?

Will they drop the fares on Te Huia as well? Not sure it counts as public transport under their definition.

Unfortunately the price of fuel at the pump is going to increase over the following weeks. The Prime Minister is not doing enough to reduces prices at the pump as a consequence for working people and lower income people who heavily rely on fuel for work and grocery shopping are going to suffer from transport poverty and lasting consequences from other areas too like job prospects and putting food on the table. . – $0.25 cents deduction a litre won’t be enough to stimulate the accumulating fuel prices, it doesn’t go far enough to keep up with the rising fuel prices. The petrol stations across the country which had to enact the price change won’t keep that promise for the long term and will pass it onto the consumers. As a consequence the working class and lower income people will suffer if no immediate action is taken reduce the prices further at the pump!

We will see the prices rises again because the petrol station themselves are not making enough ‘Revenue’ for them to sustain themselves to run and need to be able to have savings in-event of weather emergencies or natural disasters. One of the contributing factors is the rising price of each barrel having to import into the country due to the rising barrel of Crude oil prices along with having to keep up paying for fuel tax and levies which comes with it. If the rising price of Crude continues, it’s not going to be sustainable and feasible for them to operate and would be forced to shut their doors cause they can’t keep up with their payments. Another factor into why is economic trade, we’re getting these oils from UAE, Saudi Arabia, Iraq, Kuwait and Iran where we don’t have any close relations with them, that why its becoming expensive to buy their oil! Since the USA/Canada one of our closets relations and used to be big producer of oil but doesn’t produce oil anymore, we have to depend on countries we don’t have close ties with for the long term because our close related countries don’t produce as much oil anymore like they use too.

What do we need to about it, We need to get rid of the fuel tax and levies to alleviate stress for both the fuel companies and the being passed onto the consumer and keep the ETS. It would definitely stop the fuel prices from accumulating to a rate where’s its near impossible to purchase, if the government doesn’t enact on rising prices, it’ll keep on rising further and make historic prices. Lower income won’t be able to afford buying a vehicle because their new type of car and not gone through a long life cycle yet, also their not many second hand vehicles on-market yet to help transition to electric. On-top were already seeing people who can afford the transition switching to electric vehicles it would be no point in keeping the tax and levies in the long term since not enough petrol powered cars wouldn’t be turning up at the pump since electric vehicles don’t require a fuel station to recharge and go. With petrol powered cars coming to the country, we should be looking to banning importing them by this decade not the next one, once there’s enough second hand electric vehicles (2025-2026) on-market, the government should towards banning the petrol powered vehicles immediately by this decade, not 2035 or 2040!

The fuel tax, levies should be going towards funding for transport problems since it’s worth $10 Billion a year! For our transport problems we know there not enough convenient transport for people across New Zealand everywhere, that’s why we should get rid of the fuel tax and pay for transport projects in general tax. It will provide people with transport option in future if we putted more funding onto transport projects and get them done quicker too to combat our transport woes.

Especially here in Auckland, the fuel prices at the pump are expensive. We need to get rid of the ‘Auckland Regional Fuel Tax’ and instead place road tolls to help fund transport projects across the region. It makes sense to get rid of the ‘Auckland Regional Fuel Tax’ since is only being partially funded by Aucklanders paying fuel at the pump and then the tax goes to Auckland Transport for funding. Majority of the funding of the for ATAP(Auckland Transport Alignment Plan) is coming from the Crown/incumbent government NLTP fund worth $16.3 Billion as of June 2021 which is being funded instead of Aucklanders themselves. It makes no sense to continue with the ‘Auckland Regional Fuel Tax’ if most of the funding is coming from the Crown, you may as-well place the funding in our general taxation instead and then pass it down onto the NLTP fund. It would definitely help fund for more projects to be completed faster, also get projects underway now instead of waiting years for them to start and have transport modes functioning/operating sooner rather than later.

As for the rest of country, they need transport modes to be provided too since they lack in these necessities and transport deprived. Their never going to get much projects cause of amount of spending by the current government is creating and leaving no room for transport funding to be provided as a whole while some parts of the country get left out and left behind. Some of our smaller cities don’t even have functioning and running reliable transport to help combat the growing fuel prices, what’s the government going to do about that problem? Where’s the room going to be for them?

Solution is simple, we need to invest in critical transport infastructure along with providing transport vehicles to help people with transport to work, social events and shopping. We need to invest in more electric buses for all our cities across New Zealand. For our big cites Auckland, Hamilton, Wellington and Christchurch invest in more rail transport to help curb congestion on our roads which we face on daily basis, also bring reliable services and fast transport for people to commute. For Auckland we need to invest in Heavy rail line on Southern Line by creating four lines, extended Onehunga line to the Airport, Puhinui to Airport and North Shore line instead of their aggresses spending on 3 lines which could cost between $42 Billion – $87 Billion, a build we cannot afford as a country. Hamilton we need to electrify line from Pukekohe – Te Rapa to make more speedy commute by rail to Hamilton and vice versa, instead of continuing the Te Huia service which is ineffective. For Wellington we need double track from Porirua to Paraparaumu so trains can go faster. Lastly Christchurch we need to invest in current Heavy rail by double tracking and electrify them.

The government needs to remove tax and levies immediately, otherwise we’re going to see experiential increases in fuel prices and un-sustainability for the petrol stations to operate which will result in petrol stations shutting down a lot faster when people can’t make transition to electric vehicles or public transport due their financial circumstance or geographical location.