The cost of living has been getting a lot of focus lately as inflation rears its ugly head. One of the areas getting a lot of attention has been skyrocketing fuel prices, surging to all-time highs of around $3 per litre, and they’re only likely to get worse as a madman continues to launch actual rockets as part of a horrific invasion.

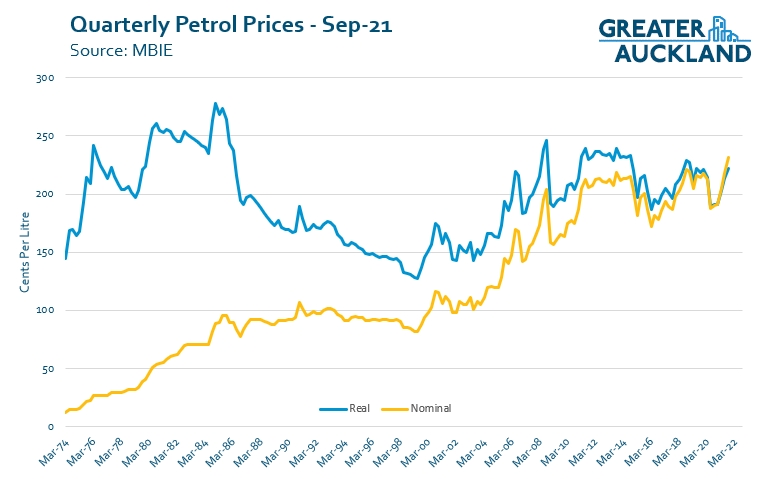

To put petrol prices further into perspective, this is from MBIE’s longer term data – which is only till September 2021. Even accounting for inflation it appears that prices now are even higher than they were in the 70’s and 80’s.

There’s little we can do about how much it costs to import fuel but in order to help ease the pain there have once again been calls from National to scrap 10c per litre Auckland’s Regional Fuel Tax (RFT). National have been calling for this since it was introduced in 2018.

The RFT certainly isn’t perfect, it’s a fairly blunt and somewhat regressive tool, especially as people on lower income households are more likely to have longer journeys and with fewer viable alternatives to cars than those living in inner areas. One benefit of the RFT over other forms of raising revenue is it does help provide a little incentive to avoid it by not driving.

All up the RFT is designed to collect about $1.5 billion over a 10-year period, however, the impact of it is a lot larger than this. The way transport funding in New Zealand works is that Waka Kotahi co-fund high priority transport projects that a Council has money for. As a general rule of thumb, they will provide 50% of the costs but in some cases they may provide more. If the Council doesn’t have the money, then the Waka Kotahi money ends up going to another region or on projects that don’t need Council funding (like motorways).

Similarly, the Regional Fuel Tax also makes it possible to do projects that also justify being funded through Development Contributions. Ultimately, this means the $1.5 billion of Regional Fuel Tax actually allows Auckland Transport’s investment programme to be nearly $4.3 billion, much bigger than it would otherwise be able to afford.

These projects aren’t just nice to haves either. The RFT is funding some regionally significant projects, such as the Eastern Busway which just so happens to be in National leader Chris Luxon’s electorate. A high-level summary of the areas the RFT is contributing to is below – from the consultation last year.

If the RFT was to be removed it would likely mean one of three things:

- The council would have to make up the funding another way. The most likely way would be via a general rates increase which in the past the council have said would see rates by around 10% on top of the normal rates rises. Such a large rates increase would usually be political suicide for the Council but in this case the Council could quite clearly put the blame the government and say that they’ve been forced into the rates increase.

- The government might look to cover the lost funding themselves. In its most simplest form, they could just cover the $150 million annually from general taxes. This would be relatively easy to do and would ensure the current funding from the NZTA remains unaffected. The downside to this is the optics from the rest of the country which might be perceived as just ‘ploughing more money into Auckland’ at the expense of the regions.

- The Council and government would need to renegotiate plans like the Auckland Transport Alignment Project. This could see projects cancelled, delayed or reduced in scope in order to fit within a new funding envelope. For Aucklanders who already worry about not enough progress being made, this will only make it worse.

The same issues apply not just to the RFT but also the wider fuel tax take which contributes transport funding around the country via the National Land Transport Fund. As it is that fund is over-subscribed and many projects go unfunded. There’s also the issue that global supply chain challenges mean the cost of delivering projects has increased significantly, further putting pressure on the fund.

The bigger issue here is just how dependant on petrol we have made our transport system. For decades we focused on only building one element of our transport system, more roads for cars, with almost no investment in alternatives until more recently. Our non-driving modes have around 60 years of no development to catch up on. That catch up hasn’t always been smooth either, such as ATs delivery of cycleways almost grinding to a halt for a few years.

All this means is that for most people there is very little viable opportunity to not drive and this has been even further compounded in recent years by the pandemic making public transport both less attractive, and particularly more recently, less reliable.

Notably, many of the projects funded by the RFT are all about helping to provide those alternative options.

If National and the government really want to help people to avoid the impact of high fuel prices they should urgently look at ways to help get people out of their cars. For example, how about them funding and supporting a programme of pop-up bike lanes in cities all around the country by replacing on-street carparking?

And they could help get people on to bikes in other ways too. It’s crazy that the government will help subsidise an electric car by as much as $8,600 but won’t provide any support for e-bikes which helps not only reduce costs of transport and emissions for people but also helps reduces congestion. These options and others were just some of the 10 recommendations made in a study a few years ago by Dr Kirsty Wild.

Electric City’s 10 recommendations:

- Provide more separated cycle lanes.

- Provide free-flowing, protected cycle highways within the 15km e-bike ‘goldilocks zone’.

- Separate pedestrians from cyclists where possible.

- If an e-bike speed cut out is introduced, it is recommended that it be 32km/hr rather than 25km/hr.

- Reduce the speed limits on more urban roads to 30km/hr.

- Provide opportunities for people to try out an e-bike for a trial period of two weeks.

- Reduce the cost of e-bikes.

- Create a new ‘E-bikes at work’ website

- Investigate opportunities to make e-bikes available to low-income people.

- Provide more secure bike parking, with e-bike charging facilities.

Processing...

Processing...

[Deleted – off topic]

I fully support an evidence and risk based approach to setting safe and appropiate speed limits on roads throughout NZ, rather than the sweeping generalistaIons that have been the base line for many years. Every year a frightening number of NZ drivers demonstrate they are wholly incapable of driving to the conditions, therefore greater regulation is appropiate to help protect them and other road users.

As for the post being pro cycling/lobbist, thats kind of the point! Pretty much everything in the post is reflecting back to AT/NZTA/Govt what their advisors reccommended they should do vs. the actions that were or weren’t taken.

I agree Ivor, but what is the point of regulations if they are not enforced?

Will Greater Auckland be writing about the planned RUC changes?

https://www.transport.govt.nz/consultations/road-user-charges-consultation

Depending on implementation it could serve as a bit more of a progressive transport funding source. Could change the tide of vehicle inflation, more appropriately charge heavy trucking, charge for externalities to go into mitigation.

The TLDR is they want to change the system to capture more costs, including more externalities.

I imagine we will.

I notice the page on externalities focuses on greenhouse gases, and makes no mention of health. It really would be preferable if the country could discuss things properly.

The arguments above would be fine if AT was actually undertaking the projects that it promised to use the fuel tax money for, but its not,

AT/ Auckland Council are currently sitting on ~$285 million that it has not spent, (this is over 50% of the $515 million collected over the first 3.5 years of the 10 year plan..)

https://www.nzherald.co.nz/nz/politics/auckland-sitting-on-285m-fuel-tax-windfall-with-more-than-half-of-all-fuel-tax-unspent/SJ7CZTRYORTV5JALUH2V5QNERQ/

There could certainly be a case for at least suspending the RFP for 6 months to help with the spike being caused by the war, and then revaluating at that point, and should the need arise add an extra 6 months on to the end of the 10 year period..

I don’t really understand this talking point.

So AT aren’t falling over themselves to have a $0.00 balance in the bank account, and inevitably have Herald articles griping about how could they be so irresponsible to spend their windfall instantly on the first shiny thing that crossed the desk.

They are trying to squeeze as much money out of central govt as possible even if that takes longer.

And not all of their strategic projects happen to be ready to build at the drop of a hat? I would assume contractors have plenty of work at the moment and aren’t ready to start a $900 million project next week if trev at AT calls them up. Let alone geotech and services surveys, design work etc.

The eastern busway project alone will eat that “surplus”

What would be much more interesting is to see AT’s graphs on the projected balance of that account into the future. If this wasn’t temporary while they ramp up to actually building more stuff then I would be disappointed.

Pretty sure that $285 million when to buy trains.

But yes, AT could be doing a hell of more to get people moving around the city. The frequent bus expansion, might be a game changer for Auckland. That will only be the case if, they give the busses space.

Some how the fuel companies have equalised the regional fuel tax across the whole of New Zealand with prices in Auckland being no dearer than anywhere else.

It will be interesting how people respond to rising fuel prices. Some will walk, cycle and switch to public transport. But most will just moan and demand tax reductions. I expect there will be a drop in vehicle kilometres. I haven’t got much sympathy for them. However not everybody can live on a frequent bus route close to an electric rail line. Its a pity we aren’t further down the electrification route for our public transport fleet. However I expect higher prices will accelerate change. Renewable power generation is being boosted with plans for new solar, wind , batteries and geothermal generation. Apparently OMV has revitalised the Maui gas field just in time to avoid us having to burn coal at Huntly during the present settled dry spell which has seeing low hydro and wind generation. I had a look at Wellingtons new Electric ferry. Very nice but I couldn’t ride because it hadn’t finished its survey it has now. Its good to see New Zealand innovation I hope we can see it other modes like buses or even trains.

Depends on where you go. It is significantly cheaper here in Taranaki and was last time I was in the Waikato and also Southland recently. Other places are similar to Auckland.

Gaspy tells me that of the five cheapest stations in NZ, none of them are in Auckland and they look to be about 50c lower than a typical 91 price.

Auckland is also a bigger market and closer to refineries, so less additional transport cost per litre. That may be masking the effect of the Regional Fuel Tax that I note was introduced and then specifically ruled out for any other part of NZ. Strange that.

Wellington currently has fuel prices even higher than Auckland’s, despite there being no fuel surcharge here. And bizarrely, despite Eketahuna being slap bang in the middle of nowhere, its fuel prices are about 30c cheaper than the capital. Makes…. no sense to me.

However – my response to that is that I just use my car less. Still to get to the stage where I can sell the car – but I have an order in for an electric motorbike (FTN Motion) instead. So, ultimately, all good.

With a user name of Guy M – you should go well on the motorbike!

Is it the pandemic that’s made PT less reliable or the months long shutdowns due to cracked tracks. Or the decades worth of work backlogs being addressed with constant shutdowns, ferries with no crew available etc etc. Covid may have made PT less attractive to many people even though there’s no real evidence that buses, trains and ferries are particularly risky. But it’s the decades of cars only funding that’s made it less reliable in recent years. And likely to continue at least to 2024.

It’s all of it. But when AT announced it would cancel services at a moment’s notice if the drivers called in sick with Covid it left people knowing the unreliability was anytime, anywhere. And they have indeed cancelled services, so it’s a pretty comprehensive layer of unreliability. This is, of course, something that comes with the pandemic, and there’s a whole world of cities to learn from. AT had plenty of time to plan around it.

Responsible planning would have included a network of pop up bike lanes to give us options. This would have mitigated the level of unreliability for some people.

Unfortunately, AT made the decision early on in 2020 that Covid case numbers were dropping and whether people would use cyclelanes was an unknown, and that there might be concern about parking, so temporary measures would be removed at L2, as most were.

So, we have what we have. A shitty city. An unreliable city. An unsafe city.

It took my breath away, that announcement from AT that they bore no responsibility for running public transport at all due to covid. I take a wee folding bike on the train with me (last mile solution) and I had a vision of trying to ride it 30km home along Great South Road. Riding home should be a (lengthy) option I could choose, but actually no because it’s wildly unsafe and I’d be paralysed by fear if not of actually being hit by a truck.

Like most things the fuel price is based on the balance of supply to demand and we’re currently seeing a massive supply side shock as Russia provides about 10% of the world’s global supply of 100mBls (give or take). She uses 4mBls herself leaving the world up to 6mBls/day (6%) short. The rest of the supply countries can’t decide just to clap their hands in glee over the increased income or supply the shortfall. They’re pretending to do the latter. There’s not much NZ can do on the supply side and lots we do on the demand side (as Matt points out above). The last thing we should do is reduce the fuel taxes as that just supports the demand and hands further profits to the suppliers. Simply choose to use less in the short term and wean yourself off the stuff in the medium/long term.

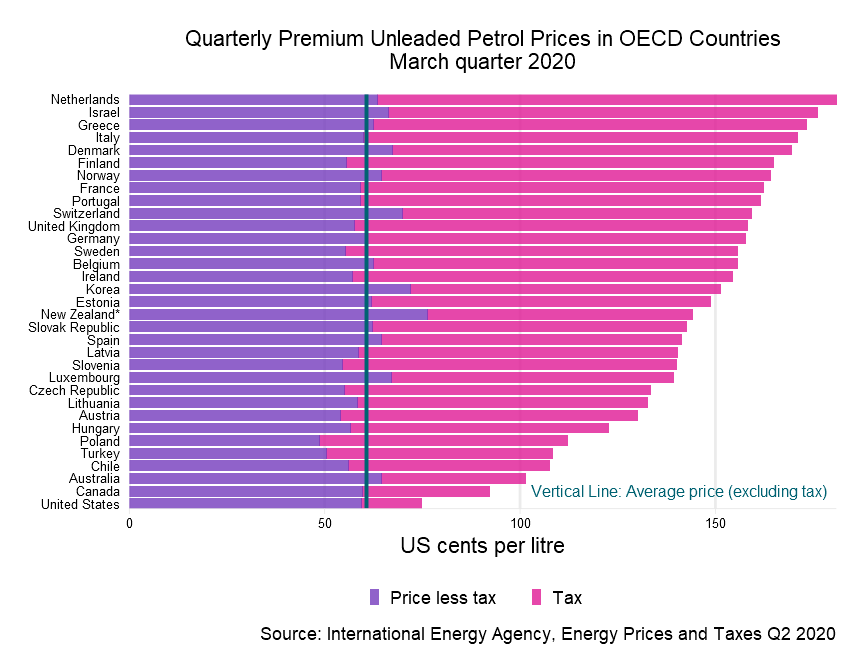

High fuel prices are a result of domestic inflation, the USA becoming a net importer again, sanctions on Russia, and our exchange rate. Yes we have a lot of tax here too, more so than most other countries outside europe.

https://www.globalpetrolprices.com/gasoline_prices/

If we are to transition away from fossil fuels, it is necessary that fuel prices increase. Yes its painful and adds to cost of living and to overall inflation but that is the price

There’s one group in the community who should be asked to do more to hasten our transition away from burning oil products to power transport and that’s the home owning boomers who are all sitting on massive capital gains from the recent decades of house price inflation.

Sure they first got their driver’s licence in the 1960s or 70s and are still proud of their ability to hill start with a manual gearbox. If they don’t still change their own oil they certainly have the kit at the back of the garage and they know all about range anxiety and 25other reasons EVs aren’t up to it.

Time to get over yourselves folks. You & your peers should be leading the charge towards EV ownership. You have the capital, you travel shorter distances and have the time to sit at a public charger waits for a boost if you make a longer journey.

So instead of glad handing Luxon over his promise the keep funding oil states go buy an EV and you’ll actual find they’re quicker off the blocks than your hazy memory of wheel spinning your mums 1100.

Very good point but I can’t get myself to do it I expect a lot of my generation feel the same. So I will stick to walking, bus and train. With occasional longer trip by car. A lot of older people car around and never use public transport which is stupid as it is free. So I suppose its up to the younger ones to make the switch or decide to forgo a car altogether. Also business and Govt should be buying electric vehicles. They even have tax write offs.

I don’t see any problem. Crude oil is $NZ141per barrel. In 1981 it peaked at $NZ160. Adjusted for inflation that is $NZ691 in 2021 dollars.

Sorry ignore that. The 1981 cost was already inflation adjusted to 2005. So its real cost is $230 in 2021 dollars.

That mode share map of Auckland is quite telling. The 85-100 % areas show why ALR City-Mangare-Airport employment park is important, why LTNs and cycle routes for Mangere and Manurewa are important, and why Airport to Botany needs to do something about Flat Bush. None of these would be happening without special funding streams such as RFT. Also, some of the delivery (where it depends on property purchase) will be invisible for some time, and is not worth rushing with insane land market prices, which just feed the banks with heavy debt repayments.

+1

We need a holistic approach

1) Travel is just s derived demand from spatial land use allocation. Land use & travel need to be planned together. The current NZ system is too fragmented.

2) The governments 3 houses per section doesnt go nearly far enough. People will still have to drive to the shops & services as it is not dense enough to drive mixed use development. The NPS at around 6 storeys might but it only applies to certain cities and allows leakage of low density development outside the city boundaries. The density should only be limited on an effects basis.

3) The fuel excise tax is still too low. Vehicle drivers remain heavily subsidised & cross subsidised. These need to be removed over time.

4) We need the nationwide vision zero/zero carbon compulsory design standard so that people can safely choose to walk, cycle & use micromobility.

I don’t think anyone quite understands the shock that is about to hit western economies. it’s going to be every bit as harsh as the sanctions against Russia, and I think $4 petrol may be just weeks away. It jumped 20 cents just tonight, though the prices are so volatile it could just as easily jump down 20 cents tomorrow before rising again.

It’s not just the high cost of filling your tank, it’s the cost of everything really, as everything needs to be transported. The high grocery and consumer goods prices are about to get a lot higher.

The government is still spending like there’s no tomorrow, so the next government is going to have one hell of a financial mess to clean up. We shouldn’t expect large scale expensive transport projects of any kind. The economy is going to be too fragile and resources to build too scarce and too expensive. Globally.

I’m furiously getting my winter garden prepped after harvesting my summer foods, and also have a few late season summer crops on the go. Also collecting firewood like crazy, as electricity prices are likely to go through the roof. I suggest as many people as possible do the same.

Petrol prices around New Zealand now is about to go average $4 a litre, it becoming difficult to keep up with the rising costs for lower and middle income. Today the Act Party has released ‘Carbon Tax Refund’ policy they say will return a carbon dividend of $749. But that is not enough to help lower income families across the country, particularly in Auckland where it’s more expensive to live there compared to anywhere else in the country and is becoming near impossible to live in right now.

One of the contributing factors is the ‘Auckland Regional Fuel Tax’, It has increased the price of fuel which people need for work(involves the need for private vehicle or requirement) or grocery shopping. For every litre someone purchase at the fuel pump it cost $0.10 a litre that also includes GST which is extra $0.15. Most people at the fuel pump purchase every week is about 60 Litres, If you were calculate that it would equate to $15 every time you head to the fuel pump. That’s almost equivalent to a bus fare for work every week. If cost reach $4 per litre and you purchase 60 litres of fuel, that would equal $240 every time you head to fuel pump and we know the lowest income and some middle income won’t be able to afford that especially if they live in a place where they have transport poverty or deprivation.

If you live in Auckland and include ‘Auckland Regional Fuel Tax’ that equates towards $255 every time especially if you’re on lower income. Also almost the same cost for going grocery shopping. People on lower income won’t be able to afford to seek other alternatives such as delivering groceries to their door cause their will be other people in the same position who can’t afford riding a car to the grocery store and expect delivery truck driver to deliver to their doorstep, which affects the ability to be able to deliver and effects flow-on effect of the grocery stores too since they do not have enough trucks to deliver the groceries to the people.

What they need to do is scrap the ‘Auckland Regional Fuel Tax’ and staft targeting the highest income people particularly in Auckland. Here in Auckland we need to scrap and replace it with some ‘Road Tolls’, place road tolls on roads as an alternative to funding public transport in Auckland. Auckland Council needs to target our main roads which head to the CBD which head to the city along with adding them in the ‘Outer City Fringes’ and all CBD streets. Streets we need to start placing ‘Road Tolls’ are Great South Rd, Great North Rd, New North Rd, Tamaki Dr, Fanshawe St, Sandringham Rd, Dominion Rd, Mt Eden Rd, Ponsonby Rd, College Hill, Manukau Rd and Remuera Rd. Those street are highly congested every peak day and even during the busy weekends if there’s a special celebration of some sort.

Even the Minister of Transport himself has admitted on a regular basis every time on Facebook videoing himself, he said the 25 bus on Dominion Rd its always ‘Congested’, so why not introduce some ‘Road Tolls’ to help curb congestion in his community and more frequent buses too since he says the bus is reaching over capacity? It helps pay for public transport projects and existing public transport infrastructure which need to maintenanced or fixed.

This would definitely target the highest income and not the lower income, not only that it would reduce the congestion and private vehicle use on our road particularly on peak where it has the most use. Not only that it would alleviate stress of being able to afford to by fuel at the pump for those who don’t have accessible public transport in their area.