This is a guest post from reader Brendon Harré. It was originally posted on his Medium blog.

“We shape our buildings; thereafter, they shape us” – Winston Churchill

Renting in New Zealand is bad — is how I have written about housing in the last few months. Nobody disputes the narrative. New Zealand’s housing market has become so farcical it is an object of satire. Getting on the property ladder is like joining the landed gentry class in a Jane Austin novel, and mocked for it — Pride and Property, an Austentatious tale.

These kinds of stories cast landlords as a villain in the nation’s story. There is a legitimate beef too — landlords did not pass on lower costs to their tenants. At the start of Covid the Reserve Bank slashed interest rates to protect New Zealanders from a teetering economy. Property investors did not share this benefit with tenants — the data shows rents rose — instead investors used their improved financial position to expand their property portfolios by buying up existing houses.

Landlord greed and first home buyers ‘fear of missing out’ drove up house prices 23% in the last 12 months. Housing has caused the otherwise successful ‘team of 5 million’ to fracture into groups of greed, fear and for those with no hope of ever buying a home — despair.

Given the way landlords collectively behaved it is not surprising the government decided to remove some of their financial privileges. Extending the bright-line test for assessing capital gains to 10 years for residential property investments whilst also progressively removing the ability to deduct mortgage interest costs for tax purposes over the next four years.

There has been much squealing and threats from landlords. Claiming they will hike up rents and make tenants homeless. I doubt this will change the governments mind. Partly because the threats make no sense (why would rents increase due to the loss of interest deductibility when they did not reduce when interest rates fell?), and partly because this sort of intimidating behaviour just reinforces the villain narrative.

Financial experts who have run the numbers show tenants shouldn’t worry about rent increases coming from the housing changes (they should worry about lack of housing supply though).

Also the government by restricting property investors ability to debt-leverage house purchases means they have remove demand from the highest marginal buyer in the housing market — so they are on sound footing with the claim they are removing demand that has most recently hiked up house prices.

The government have firmly indicated that those landlords who invest in build-to-rents will retain the ability to deduct mortgage interest costs, with Prime Minister Ardern saying at her recent housing announcement.

My message to investors. We have a need here in New Zealand, work with us, invest in new-builds, that will take the pressure off the rental market, grow the number of houses being built in New Zealand, that is a key part in how we have designed this package.

Landlords should take Ardern’s message seriously. They can do this by supporting the narrative that the real villain in New Zealand’s housing story are the rules that add needless expense and restriction on building housing near employment and amenity.

For landlords with an investment commodity perspective if house price increases are slowing then their best course of action is to realise the gains made (by the same logic forest owners harvest their wood when growth slows to a rate under alternative investment returns). Perhaps by sale, but for some landlords the better opportunity is to construct new houses. Many landlords will be in a situation where they can replace a single household rental with a far bigger building, that can accommodate many households.

An example of this would be the below single house in Mt Albert, Auckland.

Which was recently transformed by the construction company Ockham Residential into a 32 unit build-to-rent apartment called Modal.

This transformation was enabled by the 2016 Auckland Unitary Plan which was much more permissive than previous district plans. The government has further removed unnecessary building restrictions last year with its National Policy Statement on Urban Development. When implemented by Councils this will remove car parking minimum requirements and allow buildings six stories high within walking distance of rapid transit and frequent public transport.

This change in the built environment reflects a diversification in consumer demand in what is considered a ‘dream home’. For the postwar middle-class the dream was a big car outside a suburban home. Now, for many, it is multifamily housing and good restaurants in mixed-use, walkable neighbourhoods.

The underlying political theory for why central government is involving itself in urban planning is given by the maximum — “if you can’t solve a problem, enlarge it.”

Japan is the best example of the power of “enlarge it!”. It’s system of regulating housing has always been simple, uniform, and markedly more welcoming to homes of many sizes and types than are other nations’. In recent decades this national control has grown stronger and this is the secret for how cities like Tokyo and Osaka have been able to build at a far higher rate, to keep housing more affordable, than most other comparable sized cities internationally.

In Auckland there are about 500,000 residential property titles — mostly stand alone housing — reflecting past provision of the egalitarian housing dream.

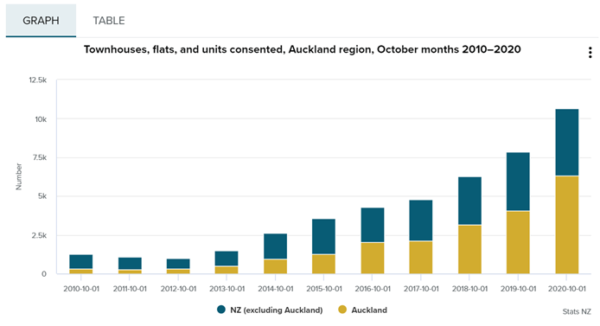

Auckland’s upward build potential is massive. For every 0.1% of Auckland’s housing stock that makes a Mt Albert type transformation then 500 houses become 16,000 apartment units. That is more apartments than the number of multi-unit dwellings consented nationwide in any year of the last decade.

About two-thirds of New Zealand’s housing stock is owned by people who own two or more houses. Many of them being ‘mum and dad landlords’ who own one (13%) or two (6%) houses in addition to the family home.

So future Mt Albert type transformations will frequently involve houses owned by property investors.

Investors should be working with the government on how to streamline this process. Ardern’s call to “work with us” is sensible. You can see in the above bar graph that New Zealand is ramping up the build-rate of diversified housing types, but this transformation is still in its early stages.

What would help?

The best approach would be for government and the investor community to talk to each other in a constructive manner (like good teams do) to identify the most pressing issues.

From the authors perspective here are some issues that could do with some further work.

More planning rule liberalisation — perhaps issues like balcony requirements, viewshafts etc. Are the benefits of these sort of planning rules worth the cost? RMA reform is coming so there is an opportunity to make further changes.

New Zealand may need more low transaction cost legal mechanisms to manage upzoning effects between neighbours. For example, I suspect the above Modal apartment build gained permission from its neighbour to breach the district plan recession plane rule. A 2017 amendment to the RMA allowed this sort of negotiation. The general concept is called hyperlocal-upzoning.

Assistance with financing may be required. A property financier has suggested the government underwrite development loans to increase housing supply. New Zealand governments as far back as the intensification of wool estates into dairy and lamb farming units have used credit advances as an economic tool (Government Advances to Settlers Act 1894) so there is precedent for making this request.

Another option would be to give tax advantages (exemption from the bright-line test?) to property owners who undertake the Mt Albert type transformation where they exchange ‘flats-for-land’. Something like 20% of the new-build flats in exchange for a buildable plot of land — so for the Mt Albert example it would be six flats.

The flats-for-land system has been successful overseas in improving apartment building supply (details here, here and here). It reduces the capital requirement barrier and because the build contract is ‘enforced’ by the original landowner then the developer is held to account for the quality and speed of the build — drip feeding the market is not possible. These factors could improved elasticity of supply for residential construction. For New Zealand which is prone to the small market — lack of competition problem, the flats-for-land approach could improve competitiveness.

More work is needed on reforming insurance for the construction sector. The leaky buildings saga should not be repeated. Yet some change is needed to address local government being risk-adverse because the current joint liability system meant they were the ‘last-man-standing’.

Multi-story and multi-unit buildings are more likely to be built from reinforced concrete due to the greater amount of structural strength required for taller and bulkier buildings. This is problematic for New Zealand meeting its climate change targets. Fortunately engineered wooden constructed apartments which sequesters carbon are now possible — in fact, if innovative wood products are used more frequently it is estimated New Zealand’s new building stock can achieve carbon neutrality by 2025. The positive externality achieved by sequestering carbon in the built environment should be incentivised in some manner.

Business journalist Patrick Smellie in an article titled — Six things to help fix the building timber shortage — makes the case for the government to get a move on with the Industry Transformation Plan for Wood Processing.

Processing...

Processing...

It is pretty ironic to use Modal House as an example of what landlords should do in defense of the tax increases. Modal House is a BTR and their taxes will be going up by hundreds of thousands or millions as a result of the law change. The message there is “Builder beware!”

I thought building made you exempt from the new changes?

It does

Yeah but this is an existing building that has had the rules changed on it overnight. Given it has happened to these guys, who know when the gov might decide todays new builds are old enough to start getting unfavourable tax treatment.

Modal House is an existing structure is it not?.

Investors who borrowed money to finance that building – perhaps at 80% are now looking at a significant and unexpected bump in taxation.

When they talking about building, they mean new building – presumably after March 2021.

It’s pretty rough if doing what the government wanted, just a year or two early would punish you.

‘It’s pretty rough if doing what the government wanted, just a year or two early would punish you.’

Why do we keep associating bog standard rules and taxes which apply in many, many countries as ‘punishment’.

your point is totally tangential but yes

taking away something from someone for doing some undesirable behavior is generally defined as a punishment. (in this case their behavior was desirable)

Just as a parent taking away their kids x-box for doing something naughty would be considered a punishment. Where in other kids houses they don’t have a x-box at all.

Still called a punishment.

My point was that in this case are doing exactly what the rules were, and what the government / people wanted, (as evidenced by the government leaving the old tax rules for new builds, and saying that’s what they want landlords to do)

So if they’re getting punished (correct use of the word) for doing what the government and the people want, just too early for the tax advantage, that’d be rough.

“Why do we keep associating bog standard rules and taxes which apply in many, many countries as ‘punishment’.”

They interest deductibility rule changes are unique to New Zealand.

Wrong, they were introduced by the notable communist regime of the Conservative Party in the UK in 2015. Along with an extra 3% stamp duty charge for 2nd home purchases, which would be a welcome introduction in NZ

Kraut that is completely wrong. In the UK you can avoid any loss of deductibility by having the rental in a company structure. Its completely different to NZ.

Huh, is the proposal here not to leave the rules in place for incorporated owners? I guess they’ll just have to sell the existing units to owner-occupiers then, what a shame…

It’s also unclear what will be defined as a ‘new build’. I recall some talk of it meaning that you needed to start building (or maybe getting consent) one year after buying, and that would be defined as going unconditional, not settlement date. That would make any sort of build to rent project highly risky because there are all sorts of potential delays that could push the start (or even the consent) out past that cut off point. I’d hope that wouldn’t be the way the final legislation is written but if it is, it would make big build to rent projects very risky.

This is an existing building. Guess they were foolish enough to build it a year too early.

“The government has further removed unnecessary building restrictions last year with its National Policy Statement on Urban Development. When implemented by Councils this will remove car parking minimum requirements and allow buildings six stories high within walking distance of rapid transit and frequent public transport”

What’s the timeframe supposed to be for this? When will we see these rules implemented and what loopholes Auckland council has tried to use to get out of it? Only train stations need apply etc etc? ( don’t want to come across as negative, genuinely want to know)

And what is the likelihood that the viewshafts or at least some of them could be removed? Some are semi reasonable, some are certainly not.

Is their legal status it’s just Auckland councils planning rule, or is it something protected by more than that. Treaty of waitangi I heard somewhere.

To most people it is clear that we need to intensify and build up. There are many areas in Auckland where this is happening. The story here has all but one reason why it is best to intensify.

When investing in a market people want to know the price and the returns. Just like in the sharemarket.

It would be telling to get some costs and returns of building a 32 apartment in Mt Albert and the cost and returns of building 32 houses at Warkworth. The costs would include earthworks, roads, 3 waters, congestion, on going council servicing etc. Could the owner of Okham be approached give us some numbers?

If it is shown that apartments are a clear financial returns winner then that might influence more people to change their thoughts.

The only thing the Government can do to hold back rents is to increase housing supply. They don’t control anything else. They are unwilling to manage demand and the financial issues are all neutral in the long run. In the short run, printing money probably contributed to the rush for property investment as people with cash look for real assets to shelter their wealth in.

This video explains it well. Buying property to hedge against the decreased value of the dollar as a result of governments printing money.

https://youtu.be/1HmGLV46L60

Excellent video. When you think about it houses are worth the same as they were one year ago. One house is still worth one house. But during that time the value of money has dropped which means the price in dollar terms is now 23% higher. And yes he is right, some people understand this change and load up on debt and buy a real asset to short the dollar. Factories, farms and mines are hard to buy but houses are much easier to come by. The problem is the social unrest that follows from having winners and losers.

It was Lenin who said the best way to destroy capitalism was to debauch the currency.

I think you are intelligent enough to understand the point. In real terms a house hasn’t changed value from what it was. In nominal terms the price has gone up. That is a function of the increase in quantity of money. That means you now need to swap more money for a house than you had to before because the seller knows your money is not as good as it was. If you don’t understand that try watching the video above.

The purpose of the quantitative easing is to stimulate the economy in the short run. People who see that, look thru the process. Eventually enough people will look thru it and it won’t work any more because people will factor in the lower value of cash and financial assets. That change is predicted by Robert Lucas’s Rational Expectations theory. Smart people with money are buying real assets. People without money are seeing their real wage decline. People holding cash or financial instruments are getting a haircut. Accept it or don’t, I really couldn’t care what you think.

The government has powers over demand (population and immigration). It would be interesting to see a graph of population vs housing in the past 50 years.

But both major parties are wedded to mass immigration. It artificially pumps up GDP and keeps labour costs down for business.

The fact that housing and infrastructure can’t keep up with it is ignored.

It’s absolutely not nonsense.

NZ has close to the highest per capita rate of immigration in the world. Our population growth has been driven much more by migration than natural increase.

It’s one of the key reasons why our housing, infrastructure and social services are at our beyond breaking point.

‘or’ not ‘our’

And BTW it’s much easier said than done to build huge amounts of housing and infrastructure to keep up with population growth, when the level of that growth is so high.

“even though 2/3rds of the population increase in Auckland in particular has overall been from natural increase and within-New Zealand migration.”

I’m sorry but that is just flat out wrong, certainly since 2013 when the current massive boom in population growth got underway. Internal migration is negative ie out of Auckland The vast majority of the city’s population growth is from international migration.

Turns out it’s quite difficult to build houses when the rate of immigration slows as it has in the last year. Housing and immigration are an intertwined issue that can’t easily be unravelled in the short term.

With respect I think that the government does but can’t or won’t control many other important factors that affect rents, there are a few demand side factors they control but the majority are supply side factors, for example they could, convert traditional state housing to high density, reduce demand through reduced immigration, free up public land, incentivise high density construction, sort out body corporate legislation, create pre approved multi level dwelling designs to minimise local and construction costs, abolish punitive local body costs for creating additional dwellings, promote immigration of construction related people, train school careers advisors on the benefits of a building related career, subsidise completed building apprenticeships, reverse punitive taxation measures against people who are providing rental accommodation, create decentralised developments for households that work remotely where land costs are lower and design isn’t adversely affected by existing development. House prices are not guaranteed and provide no guarantee of financial shelter, ask anyone who had to sell during any economic crisis about house prices always going up when they suffered a loss or purchased a leaky home, the core of the affordable housing idea is to reduce cost so if the current government succeeds in its goal then house prices will reduce and someone (a taxpayer) will bear that resultant loss and probably an on-going mortgage repayment cost to their lender with no interest cost deductibility despite this being a business cost. Regards.

I agree that house prices don’t always rise. But at the moment the Reserve Bank has approval to create up to $100billion of new money. Next week they will purchase $400million bonds in order to inject that amount into circulation. While this monetary process exists I am betting on land. QE only works because some people are naïve and don’t understand it and some people have no choice but to hold cash. Both of those groups get a haircut. While this is occurring some people shelter in gold, some are buying bitcoin, but I dont know how to stop people stealing either of those so I will stick with property. I honestly dont care if the government tax my capital gain because I am still likely to be better off. Eventually the QR chickens will come home but in the meantime it is worth borrowing and buying land.

That apartment interior in the picture is very pretty. Give us 200,000 of those in buildings that won’t leak, at affordable prices per bedroom and I’m in.

(I will need the ability to put a racing car in the open plan living room, but people hang art on walls so this should be no different).

NZ could do it too – if we sort out the building impediments and get the engineered wood industry humming…

“that won’t leak”. I seriously don’t understand how this seems to be so hard.

3 words — Leaky Homes Crisis.

The economy cannot be planned. And trying to plan a portion of it (e.g. housing) will end in tears as we have in NZ for generations now. The government needs to deregulate land use and allow people to build what the market wants. These current tax changes won’t work while all the demand that the government has put into the market remains (i.e. low interest rates, grants for first home buyers, use of Kiwisaver, accommodation supplement). House prices in Auckland went up 6.7% for the first quarter (and much more in the central area) so what if a person has to pay tax on that – it is still one of the best investments in town.

And the other issue is who is exactly going to do the building. Where are these builders waiting to work?

I’ll add to that. Land or rather opportunities to build housing (including transport and other infra), is the only part of the market that is mostly controlled / planned by the government.

And surprise surprise, we have huge shortages. Land (or again opportunities to build housing) is by far the largest cost associated with most housing stock, and is mostly what has seen the large price increases.

Is it? In Pt Chevalier, individual sites costing less than $2m, or pairs of sites costing around $3m have been converted into 30+ apartments, with building and other costs being far higher than the land costs.

You would expect the building is usually more expensive than the land, however I think this is highly unusual in Auckland (outside the city centre). For almost all homes the land value is greater than the improvement value, even for new builds.

You can check individual plots on the Auckland council website but I don’t know if you can get the entire data set.

For infill, yes, but I guess the point is that the ratios are different when it comes to apartment buildings.

Flip side being that the total cost is so much higher, which is why small investors can’t manage it… which is the point of the post, I guess. The larger ones can, so need to be encouraged to do this.

All sorts of policies influence the economy. It’s as much planned as, say, the built environment is planned by our legislation and plans. In both cases the policy, legislation, regulation set the scene and the individual players then contribute to the outcomes.

I should have added planned to the desired outcome. I agree the housing stock we have now is due to the policies and regulations implemented by government. It is not the natural result of people’s choices. However, my point is that planning for an outcome doesn’t work as there are far too many moving pieces.

I would argue that in New Zealand, opportunities to build housing is much more controlled and planned than most, if not all other goods and services. It is almost entirely the realm of the government.

I do recognize that its not a very objective thing to say, so moot point I guess.

Super post, thanks.

Broadly a great article, but I’m going to push back really hard on the balcony comment. Intensifying and building more apartments should not come with an amenity reduction. I get that affordability is a concern but living in an apartment without a balcony is a fast way of turning a person off inner city living. I give up a back yard but I still have friends I want to cook dinner for and have a Friday sunset drink.

Let’s get apartment smart, not small, to create vibrant cities.

The Modal roof top communal balcony and lounge can be a better approach in some cases than a small balcony for each apartment.

I think the point Andrew is that if you want a balcony you can buy it. If you don’t want one then you shouldn’t be forced to have one.

I mean, you don’t have to build an apartment that doesn’t have a balcony if you don’t want to?

Restrictions like this just limit builders flexibility to design things that fit the lots available and market demands. Lots of great apartment designs overseas don’t have balconies and are still nice.

Thanks for the follow up comments team. I agree with the sentiment (around buyer choice) but unfortunately it isn’t practicable in NZ. Developers will only build to minimum standards (i.e. the absolute least that have to) so I can foresee balconies being removed on mass from any new development. And you can get a balcony as an add on, (I tried to do that once for an off-plan development) but was told the only choice I can have is which colour tiles I want in the bathroom; black or white.

I think you are overstating things Andrew. There will be plenty of choice for balcony or no balcony because the market will demand both.

“…..living in an apartment without a balcony is a fast way of turning a person off inner city living”

This is really just a personal statement. I’ve lived in two apartments which had no balcony. Its never turned me off inner city living. I preferred a balcony, but the two came with amenities which outweighed this (at the time).

Let’s not invent rules here and there that really reflect our own preferences but actually limit others’ choices.

This post continues the story of casting landlords as villains but gets it wrong. To quote “

These kinds of stories cast landlords as a villain in the nation’s story. There is a

legitimate beef too — landlords did not pass on lower costs to their tenants”.

This assumes that landlords suddenly paid less interest in 2020 when the rates dropped. I don’t know about others, but I had property on a mix of fixed rates, so didn’t benefit. Lower interest rates don’t kick in until this year for me.

Basically there will always be some lag in the system from banks and fixed interest rates.

We did actually drop rents for our tenants as we checked in on them during L4, and they were struggling over lockdown, but that was nothing to do with interest rates.

“Landlord greed and first home buyers ‘fear of missing out’ drove up house

prices 23% in the last 12 months. Housing has caused the otherwise successful ‘

‘team of 5 million’ to fracture into groups of greed, fear and for those with no

hope of ever buying a home — despair”

So landlords are greedy, but property speculators aren’t? Some of those FHB might be people looking to just get a family home, but I suspect a lot of it was also people wanting to get on the ladder for potential profit.

I am not sure why landlords are singled out as being greedy as opposed to anybody else. I don’t feel as though I was being greedy owning a couple of small apartments in Auckland to help with future retirement plans (we had no intention of flicking them on for a quick profit even if we could). Our tenants appear to be happy, and we try to be decent people as the tenants are our customers. First home buyers can’t even reasonably buy the places we own as banks demand 50% deposit or just won’t lend on them.

I have not seen a lot of evidence of the actual split between greedy/evil property investors and the good and righteous first-home buyers driven by FOMO.

Clearly though low interest rates were introduced, demand didn’t fall as much as expected in a Covid-19 world, and some number of returning kiwis brought back cash that fuelled the fire.

Feels like government sat on the sidelines watching this happen until March 21 announcement.

“The best approach would be for government and the investor community to talk to each other in a constructive manner (like good teams do) to identify the most pressing issues”.

Agree on this. If the government had built 100k Kiwibuild homes, the market would look different, but they failed at that.

Even something like $4.8 billion in the March 21 announcement is a huge sum of taxpayer money – but at say $650k per home, that is only ~7000 new builds, which is still far from meeting demand.

So private investors are needed to invest in building to increase supply.

But the government unexpected change to interest deductibility – which was AFAIK not previously discussed or announced (which could have helped dampen demand in 2020), has certainly made me less keen to invest.

The government can announce a change on a Tuesday which applies for purchases in flight on the Saturday. That feels like very rushed tinkering with the market, yet simply announcing that removing interest deductibility was on the cards, would have had similar damping effects.

In my case the interest deductibility change has pushed my tax bill from about $3k this year to over $14k in coming years. Lower interest rates help to reduce the impact, but while rent is driven by supply and demand, we will now have to look at bumping rents more aggressively if we can. It’s going to get very messy tracking landlords with existing property vs new build (and when do new builds stop being new?). Obviously I would have preferred if the government had made announcements on this deductibility change and waited to see if LVR and other changes like bright-line pushed to 10 years

Some really sensible comments here. The heading of the article reads ” What if Landlords Built Hot New Things?” but misses the point totally as landlords generally dont build anything, developers do. The article is so driven to condem all landlords for the supposed sins of everyone involed in the property market so really misses any real solutions. If we all stopped labelling groups of people and realised there are good and bad in all sections of society, we might progress past the point of just name calling and trying to shame groups.

As a landlord myself I think that as a group, we deserve a fair bit of scorn.

Personally speaking I am tired of hearing how I am doing the “heavy lifting” of providing rentals and a “key service”. That’s not why I got into it. I am an opportunist who had money to invest and was thinking long term.

But honestly – tax me and every other person deriving wealth from the increasing value of this asset class. That includes my family home. Its the right thing to do.

Absolutely agree. As a landlord myself, I accumulate wealth by withholding a valuable natural resource (land) that others need to live on. It’s essentially a perpetual ransom.

There’s an idea that property should ideally increase in value by a certain percentage each year… and both Key and Ardern have said this. Why should it? Why is it so different from electricity to spuds and everything in between? If it does, it’s personal

enrichment without contribution, and in a fair society that should be ruthlessly discouraged. Wealth should only be gained by endeavour, and if we start with that as a prerequisite, we’d end up with a very different system than we have now. If as a society we genuinely wanted that, we could do it easily. It’s frustrating as hell.

I agree John. I also agree it is frustrating. It can be hard finding the right balance between proposing a constructive way forward and giving voice to that frustration.

Why does the whole “group” deserve to be scorned because you seem to feel some guilt? You are more than welcome to pay additional tax to the government if you wish, but I dont think you will. Its interesting that the big multinational corporations and the big earners that are abel to offset their tax through loopholes to the tune of hundreds of miliions of dollars, are not able to be controlled by our tax laws so the liability of more tax just falls to the rest of the population. The rich always get richer no matter what.

“You are more than welcome to pay additional tax to the government if you wish”

It’s impractical to consider tax as a voluntary donation.

“The rich always get richer no matter what.”

A well designed tax system can create a far more egalitarian society than what NZ’s tax system has created.

I never said tax could be voluntary, that’s why you cut and pasted my comment with the word “additional” before tax. Additional tax for those wanting to pay it is certainly practical.

I’m also interested in this well designed tax system that’s going to tax the likes of Google, but I can’t see one operating right now. The big corporations are way too big and powerful to be controlled by governments.

JasonJones its quite easy to accept the industry you have bought into without having to feel guilty. I do. Sounds like you do too. But you would have to have your eyes closed and your ears shut to say its not an industry with a pretty sour underbelly.

For every landlord who tells you over a BBQ they rent “below the market rate” is about 10 who fight every measure to ensure homes are liveable, raise the rent at any chance, raise it directly in response to more welfare assistance (check the stats on price rises at the time of increased benefits/accommodation supplements). They’ll also claim they want to be treated like any other business (interest deductibility) while also saying they should not be treated like every other business (taxing sales of capital assets). Putting up rents to cover interest deductibility costs that haven’t even kicked in for them yet, but not passing on the savings from reduced borrowing costs. I could go on, but I am sure you get the picture.

But my comments on tax weren’t targeted at property investors per se. Its the gaping whole in our tax system which allows tax free wealth generation from housing – all housing. You lament the rich using “loopholes” (more accurately, perfectly legal provisions) to avoid tax and one of the ways they (and I) do that is through housing. So without that tax, we keep lumping the burden on our salary and wage earners – including the poor as well as the struggling middle class. I and others get a tax free windfall when we sell the property and convert it to cash (after the brightline period). The mugs working get taxed every week.

Taxing wealth derived on housing would create a more equitable tax system and treat all investments of capital the same. It would allow us some room to remove the tax burden on those least able, generate tax revenue (in the realms of $10bn per year) to put into social services and, of course, housing supply. It would also be one (but not the only) measure to help with addressing the rampant house price inflation.

So at its core, its an issue of fairness in the tax system, not the politics of greed or envy.

Tax on the multinationals? The noose is closing. Recent changes to B2C inbound services and GST, Base Erosion & Profit Shifting (BEPS) via the OECD, global corporate tax rates as proposed by the US…some or all of these will take effect in due time but that is no reason to wait on what we can do at home.

@JasonJones… the solution is ridiculously simple. Don’t tax on income. But it’s such an ingrained part of our society to do that, I feel like most people don’t even notice how completely absurd it is.

If we phased out all forms of income and company tax, then we’re only encouraging productive activity. You earn it, you keep it.

If we used resource taxes instead as the primary revenue source, of which the biggest would be an annual land tax on all properties everywhere, then the incentive for those who own land is to either develop it to make it productive, wear the cost of living on it themselves, or sell it on to those who will.

We’d have phase it in slowly, so for those that have used property to store their wealth over their lifetimes aren’t sliced off at the knees. And also put the tax rate on a sliding scale so that higher $/m2 land was taxed at a higher rate. But if we wanted to do it, we could do it.

“So private investors are needed to invest in building to increase supply.

But the government unexpected change to interest deductibility – which was AFAIK not previously discussed or announced (which could have helped dampen demand in 2020), has certainly made me less keen to invest.”

Investment is your own money. Lack of deductibility pertains to the interest on the bank’s money so it will have no effect on your investment.

“I don’t feel as though I was being greedy owning a couple of small apartments in Auckland to help with future retirement plans”.

I am guessing that you also own the residence that you live in. If that is the case then you own 3 residences in an environment where housing is in short supply. Whether you hold for more than 10 years or not the probability of your making a substantial capital gain is very high…and the longer you hold onto them the higher it is likely to be.

Where do you suppose that capital gain is going to come from?

Other people is the answer. If you haven’t generated new housing with your “investment” it’s a zero-sum game whereby your gains are at someone else’s expense; in all likelihood people who are buying with after-tax income that they gained by creating wealth.

As for your “investments” being to “help with retirement plans”; how is this relevant? It seems to be part of the standard landlord narrative along with “hard-working”. Hard-working people on wages and salaries pay income tax. The longer the hours I work, for example, the more tax I pay, and it is more than proportional. I am OK with that. I am not OK with the hard work of landlords in building the capital value of their assets being effectively free of tax because it’s their retirement nest egg.

By all means try and put your rents up but the renters don’t have to take it. As travel restrictions are lifted people can and will move offshore. One of our daughters moved to Australia a couple of weeks back; similar cost of living and substantially better salary for her IT skills. The second is seriously exploring the possibility. I am sure they are not unique in not wanting to use a sizeable portion of their income to finance the retirement funds of NZ landlords.

Great article. Thanks.

The reason I don’t feel guilty about the situation is that, as someone said here, the world economy actually can’t operate without inflation, ever increasing house prices, continuous printing money etc. Its actually a financial system on the verge of collapse in some ways, especially since 2008. So the word guilty is not what I feel, it’s more like despair because fiddling with the existing system isn’t going to produce a fair outcome. It needs completely reinventing somehow.

I disagree with your estimate of 1 in 10 being a fair landlord and the rest being ruthless. Its not what I see at all so would be interested in the source of these statistics. The stats on price rises at the time of increased benefits/accommodation supplements only applies to those renting to beneficiaries so not a representative source I would think.

As far as I know putting up rents to cover interest deductibility costs that haven’t even kicked in for them yet hasn’t yet happened? I’m not sure if this is just speculation? And like all industries there has been no passing on the savings from reduced borrowing costs. Costs are still rising everywhere so that’s again just a general statement that can be applied everywhere.

The rich I was referring to aren’t rich from residential property, that’s just the wealthy middle class. The real rich have earnings deeply hidden in trusts, stock markets etc and have many other “loopholes” to avoid tax, and this will need more tax changes to close these loopholes. So yes without those tax changes we will keep lumping the burden on our salary and wage earners, well as the struggling middle class.

The poor, which is undefined here, actually don’t pay tax, as their taxation is less than their WFF and other benefits. Generally of course. It’s the struggling middle class who get nailed.

It’s interesting that the likes of Sydney, with a capital gains tax has also got rampant house price increases so it may not make a difference in the long term, we just hope the government spend these additional funds wisely to create a fairer system. Which is doubtful looking at track records. It would also be interesting to see where the $10bn per year tax revenue estimate comes from?

I hold my breath in hopes that the world governments can reign in some of the multinational corporations to actually pay their fair share of tax which would help everyone, and in the mean time lets see what the fiddling with the existing tax laws can achieve.

The $10bn (it was actually closer to $11bn), was from the TOP Party manifesto of a property tax. And it wasn’t a back of the envelope guess either. Some pretty detailed workings from ex Treasury economists.

My observations on the conduct of the property industry remains. Anecdotal? Yes, but none more so than the observations of those that claim all is well.

“The rich I was referring to aren’t rich from residential property, that’s just the wealthy middle class”. That depends from where you look at it. But regardless, they (including I) are getting untaxed on that wealth. It should not matter who it is. We should not tax all our wage earners and those earning income from other investment classes but give this one a free pass for the relative few who can afford it.

My overall point, re tax, was that not taxing wealth on housing is an uneven playing field, regardless of who is benefitting from it. The only reason we have not addressed it is because it is politically unpopular to do so. That is not the way to operate a tax system and the opportunity cost is huge.

Very interesting post, hope the government is getting some ideas for action from here.