Targeted rates seem all the rage these days with Auckland Council starting with the Interim Transport Levy under the previous administration, what became dubbed as the Bed Tax in the last annual plan, and now the myriad of water quality and environmental ones in the new Long Term Plan.

I can understand their popularity as people like to know what they paying for, and seem more willing to tolerate targeted rate rises with a clear core agenda as opposed to general rates rises which attract opposition.

An idea that has been floating in my mind since the debate over the Bed Tax has been the possibility of a Targeted Rate on Parking in the City Centre and possibly Metropolitan Centres. The targeted rate on parking would

- Act as a disincentive to land banking in major centres like the City Centre;

- Support mode shift to Public Transport and Active Modes;

- Raise revenue which could be used for City Centre Development.

Land Banking

Currently, much of the land that is being land banked often sits as parking. The targeted rate would increase the opportunity cost of land banking creating a large incentive to either develop the land into more productive users or for the owner to dispose of the property to someone who is willing to develop.

Absent a Land Tax, our taxation system creates a perverse incentive in which productive endeavours such as adding value to land by improving the land by building homes results in increased tax but sitting on land doing nothing does not, thus our tax system encourages land banking and speculation over development. A targeted rate on parking could help address this quirk.

Mode Shift

By reducing the incentive to providing parking in centres and encouraging the development of parking into more productive uses this increases the cost of driving which will encourage a mode shift towards using public transport, cycling, or walking.

Revenue raised could also be used to invest in public transport and active modes driving even more mode shift.

Centre Development

The extra revenue could be a boon to urban development and regeneration for Auckland Council and Panuku. The extra revenue raised could go a long way to helping fund the City Centre Master Plan or Panuku projects like Transform Manukau or Unlock Henderson.

International Examples

Sydney has a system that we could emulate called the Parking Space Levy which applies a levy to any residential and non-residential off-street space used or reserved for a motor vehicle.

The levy was introduced in 1992 and was increased from $950 in 2009, the scheme in 2008 before the rises was generating over $51 million in revenue for the state a year.

Melbourne has a similar system called the Congestion Levy introduced in 2005 with the levy greatly expanded in 2015 with the introduction of a category 2 zone. Category 1 levy is now $1410, while Category 2 is $1000. The levy raised $39 million in 2007.

Perth also operates a similar system, while cities in other countries operate a tax on paid parking rather than a per parking space levy such as the two Australian examples above. An interesting report by the Victorian Transport Policy Institute looks at worldwide examples and different ways of taxing parking with the preferred being a levy on spaces over a tax on paid parking.

In general a commercial parking tax (a special tax on parking rental transactions) is relatively easy to implement but tends to contradict other planning objectives. It discourages pricing of parking, encourages sprawl, and its cost burden tends to be concentrated in a few areas, such as major commercial centers, campuses and hospitals.

A per-space parking levy (a special property tax applied to parking facilities) is more challenging to implement because it requires an inventory of qualifying parking facilities, but it encourages property owners to reduce parking supply (particularly seldom-used spaces) and manage their parking supply more efficiently, and it encourages pricing of parking. As a result, it encourages more compact, accessible, multi-modal land use patterns and reduces sprawl. Its cost burden is more evenly distributed.

I think Auckland Council should seriously investigate a Targeted Rate on Parking Spaces for the City Centre and potentially the Metropolitan Centres as well.

Processing...

Processing...

I proposed rating land used for car parking during the last LTP round – but my (personal) submission disappeared without trace. This would provide an incentive to use such land for more productive purposes. However, I acknowledge that there are administrative complexities – for example the car park will not usually be on a separate titles so there would need to be some way of working out the exact area to which the special rate would apply could be tricky (possibly requiring that the affected area be surveyed). My suggestion was that small businesses (i.e those with less than x parking spaces) be exempt. Another problem is how to treat multiple-level car parks (parking structures) or office/apartment buildings which incorporate car parking in the basement (or sometimes in higher levels). An obvious target is the enormous area of parking around suburban malls and big-box retail centres which compete with and “hollow out” neighbouring village shopping centres – this is not just about finding a new source of funds, it is also about redirecting the way our suburbs function (hopefully moving away from car-centric development to more complete people-centred communities.

Yes and what about minimum parking requirements – “you must have 20 parks and you must pay us to have 20 parks”. And should they pay for disabled parks?

Presumably we can look at how the other cities have worked out the details. Exceptions are usually a bad idea, I think. They’d give small business owners an impression there’s something special about them that gives them a right.

I thought of that idea too, must be easier to administer than the AirBnB tax ! Too many carparks have been built in the city for office workers and including all the city council owned ones. Far too cheap to encourage people to move to public transport.

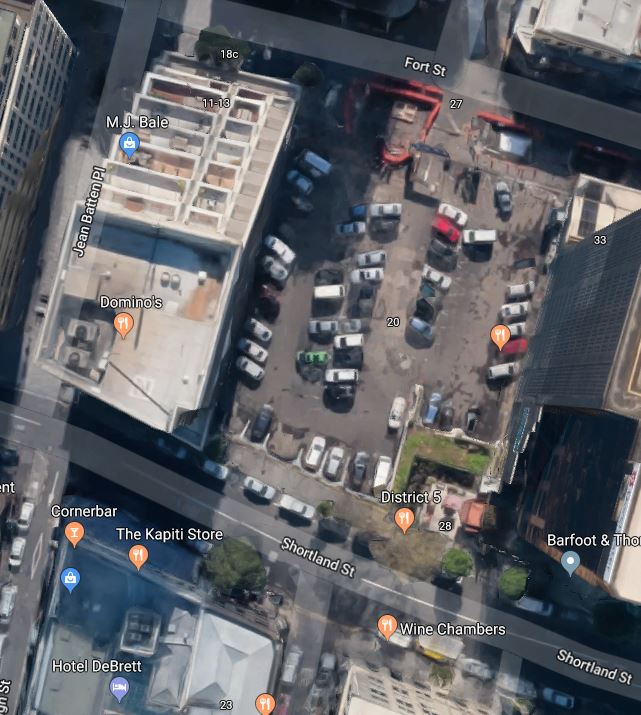

That bit of land on Fort St has been vacant for 30 years – prime location for development.

That Wilson’s car park has an early bird rate of $40/day.

https://www.wilsonparking.co.nz/park/27_27-Fort-Street_27-Fort-Street-Auckland

Counting only weekdays each space will generate $10,000 per year in income. With about 70 spaces, they will clear over $600K per annum on the site for no capital cost. No wonder they are not building.

Making money from inducing traffic, which is making us sick. Hmmmm…. We need this parking levy yesterday.

Completely agree, Harriet. And with 55,000 spaces in the city centre, at Sydney’s rate in NZD, the income would be $137.5 million.

This idea must surely appeal to all the people who opposed the regional fuel tax on equity grounds. This wouldn’t affect factory workers, or large families with people movers trying to get kids to different schools and activities, or people working in hard-to-get-to locations.

And the city centre needs fewer cars driving there – car domination makes what should be a vibrant, lovely place a dangerous, noisy and unpleasant place for the many people who live and work there.

So bring it on. First up, the money should be spent on humaninsing Nelson and Hobson Sts, including reducing lanes and installing red light cameras, etc. And converting any Council at-grade carpark land to a park, plus encouragement to private landowners to convert their carparks to gardens and courtyards for people.

This looks like a good idea, and much simpler than a London style congestion charge.

I’ve never visited another city with as much inner city parking as Auckland. Parking areas like Fort Street and Elliot street are such a miserable waste of space.

Does it differ that much from a city centre congestion charge? I wonder which one is more easy to implement?

Because some people would be willing to pay congestion charges, that method would probably involve a fair bit of transferral parking spaces from people who don’t want to pay congestion charges to those who will.

I think we need congestion charges to cover costs associated with congestion. And we need parking levies to cover costs associated with the traffic induced by parking, and with the lost opportunity to society to use that land better.

The Maritime Apartments development site on Anzac was bought for 5m and now 3 years later and nothing at all happening on the site, sold for $17.5m!

https://www.stuff.co.nz/business/108721099/kells-failed-maritime-apartments-sells-auckland-site-for-175m–triple-value-over-three-years

Until there is Capital Gains or Land Tax as discussed, people can buy land, half arse some development, say its not feasible and make a massive profit for little work.

That’s the absolutely disgusting side of our housing crisis.

It’s the reality of a land shortage. Like I get you don’t want greenfields developments, but honestly…pick one. You can’t have both cheap land that doesn’t escalate in price when you limit its supply and constraints on development of land in a city that is growing.

“It’s not Aucklanders who are asking to live in these high-value greenfield locations, it’s land developers that agitate real hard and have got this ideology that’s been accepted that it’s all about supply and demand. It’s complete bullshit.”

In case this little quote tempts you to read more, the article is here: https://www.noted.co.nz/money/property/aucklands-housing-crisis-why-freeing-up-more-land-wont-work/?fbclid=IwAR3_xuTbDXLktQR8I3C1EuHRqnFHi7pFV9oBqtwIbnjQRglE_dagdCE2dxI

In a city that has covered so much land already, you’re not going to convince me that there aren’t spots that are relatively easy to intensify. I see them daily. By ‘relatively easy’ what do I mean? I mean technically easier than building completely new roads and infrastructure to new subdivisions. Where they’re not easier is in the zoning rules and in regulations.

But should we be ruining our transport future and our food sovereignty and our carbon footprint just because we can’t get our shit together about zoning and regulation?

What I choose is a liveable city, where everyone has a right to a home, and no-one has a right to a free or subsidised parking space.

One area where it would fall over is gaining support of business owners who think the CBD should be a shopping mall where people can drive in and park for cheap.

I was reading this morning about business associations that changed their tune when they looked at the research, and became good advocates for cycling infrastructure, for example.

There needs to be a levy on uninhibited residential property also. With the current housing shortages this is a no brainer to ensure the existing housing stock is utilized as much as possible, before forcing new developments to be made in the fringe suburbs.

Time to setup a well paid panel of experts to mull it over for 10 years?

Errr, they’re called ‘Working Groups’ 😉

Don’t need a panel of experts, just send suitably senior NZTA or AT managers on expensive junkets to overseas cities to investigate and report back in a year or so.

Parking tax is act as a good incentive for mode shift to PT.

However I believe a direct Land Banking Tax is more efficient and to deal with Land Banking.

For example a fully developed multi storey parking building would pay significantly more tax than a undeveloped bare land that only provides a few parking.

The parking tax for a bare-land alone is not strong enough to discourage land banking.

Secondly is it is hard to administrate. It is very expensive for the council to stock take the number of car parks, and deals with disagreements and appeals from stakeholders.

Third is when the parking tax is so high, the land banker simply stop providing car parks and leave the land utilized. That would be much worse outcome than currently.

I suggest the best way is to increase the council rate for land component and decrease the rate for capital improvements.

If the land was no longer used for parking that would be a good result, that it wasn’t used for more productive uses would make the result less desirable, but it would still decrease parking supply, which would help with mode shift.

an empty lot is better than a parking lot surely? Whats good about helping people drive into the cbd?

Yes, I think you’re agreeing with Nik.

Good article Harriet

1) Agree land tax would be a useful tool. It can already be applied if Councils simply rate on the basis of land value rather than capital value. (Central government has skewered its own opportunity by limiting the scope of the tax working group)

2) From an idealistic point of view (& where there is no congestion toll) a CBD parking strategy is the next best tool for managing congestion:

a) No CBD property owner should provide parking (lets exclude low density residential, but there wont be much/any in a cbd)

b) Council would provide all parking in a street block (less than 300m walk) in a vertical parking tower

c) Council would charge parking fees that both cover its operating cost & manage congestion levels.

3) A parking levy on private parking (or rating supplement based on land value based rates) is the next best thing to 2), but it is indirect. The parking user wont have to consider a daily parking charge in their travel behavior. The levy will reflect only as a reduction in what companies (which purchase parking from the building owner) are willing to pay in salaries.

Why would you not try to recoup the costs of congestion separately from the costs of parking and separately from the costs of non-peak driving? They impose different costs, and to keep things fair, you wouldn’t want one type of charge to have to cover the costs imposed by all three. If it’s only congestion charging you do, for example, then you’re not capturing the costs of people who drive off-peak (using the infrastructure, polluting the waterways and air, contributing to climate change) and park in the cbd (meaning the land can’t be better used, adding to the urban heat effect, etc).

AT should sell their parking buildings before announcing this strategy! ATs subsidised parking is just more proof that they don’t really want to discourage driving to the CBD.

Well it’s the whole Kodak scenario. Company doesn’t want to screw its existing income base for unknown future revenue.

If a parking levy was applied to residential property then I’d like to see some sort of defacto decoupling of the tenancy and any attached car parks or by-right subletting of car parks by tenants. As it stands if we levy residential car parks landlords will just pace the $20-50 p/week on onto tenants who may not even use them.

Yes, excellent point. And think of how empowered the people who want better use made of the space will be once the building owner is faced with fewer people wanting the carparks.

Good to see new developments have the spaces decoupled already.

Thanks Heidi, given the right encouragement that we’ll see space reallocated in existing buildings from car parks to things like secure bike parks and storage space (for things that aren’t cars at least!). While the trends with new builds are great improving the current stock of apartments is essential unless we want to live with past mistakes for a long time to come.