Fuel taxes have been in the news a lot lately with both the proposed Regional Fuel Tax in Auckland and the nationwide increase in fuel excise duty as part of the new Government Policy Statement. As such, there has been a lot of discussion about the positives and negatives of fuel taxes as a way of raising money for transport projects.

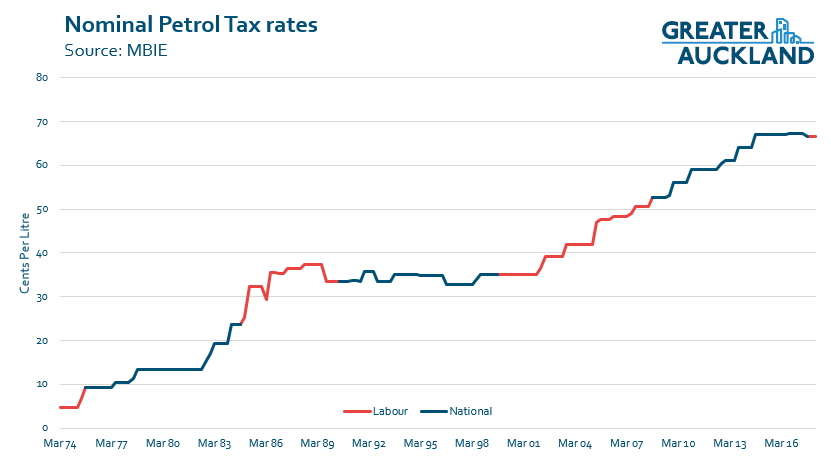

Fuel tax, technically called “fuel excise duty” (FED), is around 60 cents per litre at the moment, plus there’s another 6c/litre of ACC levies and GST adds close to another 10c/litre. With petrol currently around $2 a litre, this makes up over a third of the cost of filling up at the pump. It has gone up substantially over time too, including by around 17c/litre over the course of the previous government – although offset by some decreases ACC levy’s. Past FED rates are shown below with the colour representing which party was leading the government at the time.

Interestingly, a 3-4c/litre increase over the next three years puts us back on the general trend we’ve seen in since 2001.

Fuel taxes, alongside road user charges (which are charged on a per kilometre basis for diesel vehicles, generally increasing by axle weight) and vehicle licensing fees provide the money that NZTA distributes from the National Land Transport Fund (the NLTF). At the moment this adds up to around $3.7 billion a year.

Fuel taxes have a number of advantages and disadvantages as a tool for raising money for spending on transport. Let’s run through the advantages first:

- Cheap to collect and hard to avoid. Compared to other potential revenue options, fuel taxes are incredibly cheap and easy to collect – which means that essentially all the money raised from them can go into transport investments, without a big chunk of it being siphoned off in the collection process. The compares against other revenue systems like road tolling, where often at least 20% of the revenue is used up in administration costs and therefore can’t be spent on the projects the money is being raised for in the first place. Finally unless you go to pretty extreme lengths, it’s quite hard to avoid paying fuel taxes.

- Broadly equates with the amount you use the transport network. While fuel taxes aren’t a pure “per kilometre charge”, the more you drive the more fuel you use up and therefore the more tax you end up paying.

- Acts as a useful “defacto carbon tax”. Until we get around to deciding once and for all the world is worth saving from climate change and therefore price carbon properly, fuel taxes can act as a useful defacto carbon tax that discourages people from burning petrol and encourages them to use more fuel efficient vehicles or modes of transport (like public transport, walking and cycling).

Of course it also has some disadvantages:

- Potentially regressive. Like other taxes on goods and services (including GST itself), generally lower income households spend a higher proportion of their income on necessities and Auckland’s poor travel choices mean that getting around by car sadly remains a necessity for far too many people. Furthermore, decades of poor housing policies mean that lower income households have been priced out of inner areas and into more peripheral parts of the city, which once again makes them more likely to be dependent on their cars to get around.

- It’s a flat rate. Fuel taxes are the same, no matter when and where you are travelling – a quiet suburban street in the middle of the night or a congested motorway at peak times. However, obviously the true costs of travelling at those times are very different – both in terms of the congestion you’re creating for others and the vast transport spend that’s required to efficiently move you at peak times. At its core, the drawbacks of the flat rate is the main argument for road pricing.

There has been a lot of focus in the recent days about the “regressive” argument, both when it has come to the Regional Fuel Tax and the more recently proposed increases to fuel excise duty. I have some sympathy for this, as I noted above lower income households in Auckland are mainly located in the west and south – parts of the city that are generally more reliant on their cars to get around than more affluent areas in the central and northern parts of Auckland. But at the same time, this just highlights inequities with the current situation and the desperate need for this extra money to fund projects like light-rail to the Airport and Northwest and the AMETI busway, which will provide major car dependent parts of Auckland with quality travel choices for the first time.

Even given this, it would be sensible for the government to look at options for how they might “soften the blow” of these fuel tax increases – especially in light of the Regional Fuel Tax that will be implemented in one big go on the 1st of July. This might mean ongoing 2c per litre annual increases from next year (to avoid an overlap with the Regional Fuel Tax), rather than big initial increases for three years and then nothing. While this might mean a bit less money is available in the National Land Transport Fund initially, perhaps this could be addressed through allowing greater borrowing flexibility – shifting more towards how councils fund their capital expenditure through debt, with those who benefit from the investment once it’s complete being the ones who pay for it. Finally, I suspect it will also take a while for the big new investments the Government wants to make to “ramp up” and go through investigation, design, consenting and property purchase phases before the “big money” is required for construction.

Processing...

Processing...

If we’re going to ramp up fuel taxes, it’s time to start getting RUC implemented on EVs. Gridlock in Nissan Leafs and Teslas is still gridlock.

I so agree

Obviously they will transition to universal RUC well before EVs make up a significant part of the vehicle fleet.

At the moment that number is 2% isn’t it? I’d argue that needs to be rethought, especially given the concentration of those vehicles likely to be in Auckland and the additional regional fuel levy on Aucklanders.

You’re fiddling while Rome burns, mate.

NZ has about 6000 Evs registered about 1/3rd of those are those postal delivery vehicles (Paxsters).

The rest a mixture of pure Evs and Plug in hybrids.

These Evs will pay Rucs in time when their numbers are up to 2% of the fleet.

A likely 3 year exemption from RUCs is a fair trade off for them producing way less CO2 emissions than similar vehicles of the same type from the get go.

Whether it’s a new EV or not.

Also you’re ignoring the fact that Auckland will put many times more additional cars/suvs/trucks etc on the road each and every year from now on than all the Evs registered in NZ right now. All powered by CO2 emitting fossil fuels.

And whether fuel taxes or levies are raised or not.

But don’t you think most of those 4000 odd EV’s are owned by fairly wealthy people? Why give those people a tax break?

Given how few financial incentives NZ’ers have to buy/use EV compared to other countries, the RUC exemption is useful for helping kick start the EV market in NZ. Taking it away would reduce the uptake further which would reduce the introduction of charging stations, etc etc.

Jimbo,

You’re in real danger of throwing the baby out with the bath water.

Not necessarily are all those EV owners rich buggers.

Many of the EVs in NZ right now are actually second hand hand Japanese (or UK) Nissan Leaf imports, they cost about $15-$20K second hand – hardly being owned by rich listers.

Or a major tax avoidance exercise.

Sure some have new BMW i8s or i3s or Tesla S or Xs or rebadged Volts or whatever.

But you get leakage with any tax system. You just need to keep it managed.

And the 2% phase out limit on EVs in the overall fleet manages it and keeps a ceiling on it.

And, how do you proposed to target those Rich EV owners? Just make Auckland owners pay the regional fuel tax somehow based on what? The owners address?

Well they’ll just register their EVs to their batch in the Coromandel or whatever they have [a PO Box?] in Northland to avoid that.

As for making all EVs pay RUCs now. Exemption is to encourage uptake. So its not a accidental oversight, its a deliberate policy. For good reasons.

All RUCs go the NTLF fund, Auckland Council never sees a cent from that unless its via a NZTA fully or partially subsidised roading project.

So bring in RUCs won’t help make the fairness of Aucklanders paying for the Aucklanders clogging the roads up much better.

And what do you do now about folks from out of town who drive through Auckland, clogging up the roads? They pay nothing towards that with a regional fuel tax if they never fill up in the Auckland region. Yet contribute in spades to congestion on the motorways and roads.

And what if say NZ Bus or Ritches or whatever want to run a bunch of electric buses – should they have to pay RUCs too? Or do you make them exempt?

What about electric trucks?

[Heavy EV vehicles including Buses are RUC exempt right now like cars are until 2% fleet target is reached].

That RUC exemption for heavy vehicles is a biggish subsidy to anyone running an EV bus around the place – do you want to stub out the transitions of those vehicles to electric power to make the “tax” playing field notionally flatter in case some people ant to cheat?

Actually if 60,000 wealthy folks suddenly bought EVs to try and beat the “fuel tax” system, well we’d all be much better off in many ways and not a lot poorer congestion wise, or otherwise if they did.

So bring it on.

Got it; the feel-good factor for inner-city urbanites of having an EV is more important than the actual point of the additional fuel tax other motorists will pay, which is to help manage alternatives to congestion. Duly noted.

First stage of technology adoption –

Innovators (2.5%) – Innovators are the first individuals to adopt an innovation. Innovators are willing to take risks, youngest in age, have the highest social class, have great financial lucidity, very social and have closest contact to scientific sources and interaction with other innovators. Risk tolerance has them adopting technologies which may ultimately fail. Financial resources help absorb these failures. (Rogers 1962 5th ed, p. 282)

Greg, I’d suggest that anyone that can afford to spend $15k-$20k on a car certainly falls into the comfortably off category. It may not seem like an expensive car to you, but the huge numbers of people struggling to get by that really need tax breaks would be driving cars worth far less than that, probably under $5k.

Agree with Greg – as per this post https://www.greaterauckland.org.nz/2018/02/08/electric-vehicle-targets-2017-sales/, almost half the EVs in NZ (so far) are used Leafs, so they’re probably more mid market than upper market for now. But certainly, as far as new EVs go, the price does put them out of reach for non-high-income households.

Given the limited range of the Leaf, it’s almost exclusively a commuter vehicle. I’m still not seeing a good reason for it to remain exempt from the same charges everyone else pays.

Well ButtWizard,

50% of the spending AT does each and every year since it was formed is on repairing existing roads not building new ones or making the current ones better its just keeping the roads we have in order. AT gobbles up about 50% of the annual rate take. So a full 25% of all rates in Auckland is spent on fixing up the roads. Building new ones or widening them or making more lanes on them is well less than that portion.

NZTA pays half of the fixing up/repair costs of State Highways in the Auckland region [and every other region is close to the same number too],

So you could say that between AT and NZTA, 100 percent of the ongoing repair costs to State highways is already covered.

The average EV [a second hand Nissan Leaf in NZ] will weigh less than your average “RUC-less” petrol powered [often company] car, paying regional petrol taxes.

As the actual axle loads of the vehicle is critical to the amount of damage caused.

Your Average petrol powered car in Auckland is likely causing more damage than any of the vehicles in that fleet of EV Leafs. Due to this fact.

Even so, a whole fleet of tens of thousands of Nissan Leafs or any other <2.5T vehicle will do a fraction of the damage to the road that a few 55+ Tonne HPMV trucks do to the Auckland roads given the spread of weight over their axles. And that assumes they’re all correctly loaded weight distribution wise.

Yet, the RUCs said truck pays [as its a company vehicle and uses diesel its not overly captured by the Auckland fuel taxes especially if its fuelled from outside of Auckland], does NOT cover anywhere near even 50% of the full cost of the damage its causing to the Auckland roads. And AT never gets any of the RUC money directly, at best it gets it in kind by NZTA picking up the repair bill to 50% of the state highways.

NZTA don’t cover regional road repairs, so those HPMVs you see are literally tearing up ratepayer money as they drive down Auckland roads. With no likely real recompense from either the regional or additional national fuel taxes.

Therefore its not a few RUC-less EVs being subsidised or free loading, its actually these way more, numerous trucks that are actually not paying their way.

So quit the sniping about this being all about inner city “urban-[el]ites” having their way. Its not the case, its actually really all about the trucking industry having things had their way for far too long. So why not go have a moan about them for a change.

For the record: I don’t live in the inner city, I’m not an elite, and I don’t own an EV, but I do own a petrol powered [non plugin] hybrid that will pay the fuel taxes along with every one else.

But I don’t begrudge some folks avoiding those tax hikes by having EVs. Even If those 60,000+ additional RUC less EVs were all taxis or all driven by rich listers in the T2 or other HOV lanes – as it won’t actually make the sky fall today, tomorrow, or next year. Compared to all the other things going on that will.

And In fact if it actually did cause problems of a sort down the track, well it would be a nice problem to have. And would be easy to fix at that time.

“Quit the snipping” Nah I think I’m on pretty solid ground with “cars are congestion regardless of what’s powering them so why should they get to opt out of chipping in to build alternatives to congestion”.

But I’ll remember next time I’m stuck in gridlock where every other vehicle is a truck and not a car that I’m just being snippy. Apparently changing my Corolla’s motor for a DC motor and some LiPo cells means I’m no longer part of the problem, even if I use it the same way. Good to know.

It is important to keep in mind the context of the regional tax. It is instead of a rates rise or the current levy. These are strongly progressive and are much higher than the regional FED, so overall local taxation wil still not be so regressive overall with this addition. Additionally the previous levy captured households with zero car ownership (8% of region in 2013): Always trade- offs.

Good summary Matt – better than anything I have seen in the Herald. I particularly liked your graph which showed which party in government instituted the petrol tax increases.

Again, I haven’t seen anything like that in the Herald – just reports of juvenile name calling “we didn’t raise petrol tax, you did” etc.

+1

Clear and concise as always, thanks heaps Matt.

I’ve always thought a transport levy based on land values is a fair solution. It means the people who pay most are those who own the most productive, busy and sought-after locations (which therefore drive the greatest demand for transporting people), and those who can afford it the most. And it encourages building more densely to reduce transport distances. It also means those who choose to cycle pay their share of the infrastructure costs.

And it’s almost as easy to collect as a petrol tax.

Of course it doesn’t charge you proportionally for the congestion you create, but if part of the levy subsidises PT to make it cheaper, at least that encourages lower-congestion transport options. We can then ramp up the petrol tax later when PT provisions are more advanced.

“It also means those who choose to cycle pay their share of the infrastructure costs.”

That chestnut again. I’m happy to pay the 1% of the overall transport budget that has gone to cycling over the last 40 years. Thanks for my tax cut, mate.

I know what you mean, but now that they’ve finally started spending money on cycle infrastructure, it’s so friggin good that I never drive during peak times anymore, I only bike. Creating any kind of mandate to spend even more on cycleways without tripping the “bloody cyclists get everything for nothing” haters’ response is only a good thing, in my opinion.

But it’s the other way around. The most busy location is the CBD. If you live there you do most of your daily life on foot, so you generate less demand for expensive infrastructure.

Cycling infrastructure is only expensive because we choose to make it expensive. There’s was particularly boneheaded example on Bike Auckland the other day.

Isn’t it both ways roeland? People in inner-city burbs live there because they get easy access to the city’s gravitational centre, getting benefit from the city’s overall mass but pushing the transport burden for it on those living further out. So they generate less demand for expensive infrastructure but only provided they live space-efficiently, which is why a land value-based tax has merit.

There’s already a levy on land value called rates, which fund 50 % of local roads and roughly 25 % of the cost of running public transport.

And local roads is every road that is not classed as State Highways. So Local roads means most of the road network.

John, the fairest idea is if trucks paid for the damage they do and the upgrades they require. That would free up a lot of our rates. And if it wasn’t for the danger that motor vehicles present, and the spaced-out city that they create, cyclists and pedestrians would require a very low infrastructure spend.

The truth in what you say is that wealthy people need to be paying for the changes required, yes. This is because their wealth has only been acquired thanks to the infrastructure and sometimes quite inequitable social and financial systems built up by our forebears. The mechanisms for charging need to be behaviour-modifying. While land value based mechanisms *should* encourage intensification, modifying transport mode choice through fuel tax and price charging is also desirable.

There is a big political downside to ramping up taxes gradually. Since voters are rather “in the moment” creatures, to call it charitably, putting all the increases you are planning early in a political term is generally smart…

Yes, unless it means you end up in a political death spiral. I hardly think someone is going to change their vote based on a 2c/litre increase in fuel taxes. 12c/litre…. well, that might be different.

True – but the point is: some political pain now is likely to be well worth it.

It is best to get all the bad news out of the way at the start of the term. If they do that then the only thing that can bring them down is incompetent ministers. Which is why the PM needs to go the full Helen Clark on her broadcasting minister and then she needs to find some way to make Shane Jones stop talking.

While some are criticising the fuel levy as inferior to congestion charging they are missing the point that this is an interim measure (easy to start up and easy to shut down in a few years when we have chosen which is the preferred alternative). It can and will kick in within 3 months whereas just the debate about which form of congestion charging is best could take years, let alone the implementation. The regional fuel levy is fairly straightforward and its going to happen on July 1. There are some interesting trials overseas with GPS based congestion charging – it might pay to observe and learn from them before NZ commits to any particular system or technology.

This is an excellent point. Also complicated road pricing is likely to be extremely expensive in terms of its administration costs, which means that you end up needing tax people a lot more for the money that you actually end up raising.

The biggest problem I see is simply the mindset it promotes. We get fuel taxes because a bunch of people have a lot of dreams they want to fund with other people’s money. They genuinely believe that taking other people’s money and spending it for them will make those people better off than if they got to make their own choices.

When we eventually get road pricing it will be more of the same. A charge that is promoted as a way of funding more spending. When the real benefit of road pricing is to put a charge on congestion so people make more efficient choices. The two ideas are poles apart. Even the charge is different, if you want it to raise cash you charge a lot of people a lower price. If you want to price negative externalities associated with cars you price higher until fewer people drive. A regional fuel tax is a bad idea. A national tax at least puts a price on chunk of the carbon being emitted.

“They genuinely believe that taking other people’s money and spending it for them will make those people better off than if they got to make their own choices” – How much of National’s top tax rate cuts went into housing do you think? Imagine if that money had of gone into health, transport, building, etc, do you really think the country would be worse off?

Clearly not enough given we have a housing shortage. But taxing the crap out of people at every turn because a few people who think they are smarter than everyone else have some large pet projects they want everyone to pay for is no path to prosperity either. We saw that with Muldoon. You end up with some big projects that give little return or utility to most, some big debts, and worst of all you crowd out investment in things that can provide a return and can provide jobs.

I have voted Labour at least twice as many times as I have voted for others. In my view they are mostly better than the alternatives but I can see the problems that always occur when people think the Government can make everyone’s life better, if only we could reach deeper into people’s pockets.

Auckland voters in particular have in various elections and surveys repeatedly and quite consistently supported better walking, cycling and public transport projects and/or the politicians who supported these.

So claims of such being “pet projects” of some politicians are tiresome. These are projects that make a lot of sense AND that have the support of the majority.

Pet projects of big cost and dubious benefits? We saw those every day for the last 9 years, including billion-dollar motorways with no business case which suddenly appeared at the top of the “build it” list.

“When people think the Government can make everyone’s life better, if only we could reach deeper into people’s pockets.”

Well, that is THE key difference in opinion between people who prefer a govt light (libertarian-leaning) or an interventionist government (socialist-leaning).

I am strongly on the side of the latter at this stage of world and New Zealand history – yes, the state CAN indeed make all our lives better than they are at the moment, and if they have to tax people (including me) more than the current, historically low levels for that, fine with me.

I am certainly no libertarian and I also believe in a progressive government when it comes to health and social issues. But I have been around long enough to know that Labour (and The Greens) will always be infested with activists who are one trick ponies. There is always some wasteful thing that they think, usually without any supporting evidence, will make everyone better off. With transport that is always dangerous as we end up with white elephants. At least when there is robust assessment and evaluation we can avoid that. The issue we face now is a bunch of people who think transport is a national issue, yet it never is and when it is treated that way it always ends up shit. Your example of RoNs is evidence of that.

A better system is to raise the money through taxes but only allow it to be spent by local government when they can prove a project worthy.

As for a majority supporting whateverthehell you have no evidence of that. All you have is some survey results and they may as well have asked a kid if they would like a pony. The recent elections have had nothing to do with transport choices. They have simply been Southpark elections where we chose between a Douche and a Turd.

Damian, yes people want more transport infrastructure but no one wants to pay for it. I say this because Auckland mayors have only ever got elected by promising to ‘cap rates and reduce waste’. Everyone knows Auckland has got a transport funding shortage but so far we can’t seem to get past the paradox of raising necessary funds while promising to cut costs.

A regional tax is used so that the inequities of the national tax are minimised. Plus, to be honest, it’s a bit more politically palatable: Yes, fuel taxes are going up. Mostly for investment in new infra in Auckland (plus, a bunch of additional overdue safety improvements elsewhere, but they cost less). So by having most of the increase actually paid for by Auckland, you lessen the disquiet from elsewhere (who are already paying more per km and yet receiving less in transport funding).

Road + congestion pricing are fairer again and would presumably be combined with a petrol tax for carbon.

And yes, obviously there is an effect of “these projects need to be built so we’ll raise revenue anyway we can” by politicians. There needs to be constant pressure to ensure that those projects are justified.

Auckland has only recently (last ten years) started receiving a proportional share of transport funds per head of population. There’s decades of net payments flowing out of Auckland to other areas. Funny how there’s little talk of that historical inequity when it comes to Auckland actually getting something it badly needs.

I’d argue that while congestion charging is technically a lot ‘fairer’ than fuel tax, it is significantly more regressive. With fuel tax the cost is spread pretty evenly, 10 cents a litre probably won’t be felt that much by anyone. With congestion charging, if you are a person on a low income and you have to drive at peak on the motorway for a long distance, the cost is going to be significant (by definition, otherwise it won’t ease congestion). In fact the sole purpose of the charge is to get you off the road and leave it free for rich people; you can’t get much more regressive than that.

Congestion charges are only regressive if the money is taken from the system and spent elsewhere. If it is collected at a cordon and spent on improved travel choices for on the same corridor then it is a transfer and can be progressive. If you are on minimum wage and drive in the peak it is because you have no choice but to drive.

If I had to quit my job and go on the dole because I can no longer afford to drive to work, I don’t think I would be that happy to know that an alternative will be built in 10+ years time.

Sure but ask yourself if it is worth it to society to have someone whose travel time is worth almost nothing causing a high cost in delay to others. Maybe the road space would be better allocated to ambulances, trucks, buses, people driving as part of their job and people prepared to pay to part fund everyone else’s trip.

I think there is a difference between them not being able to afford to travel and their travel time being worth virtually nothing. If the congestion charge means a large number of people quit their jobs and go on the dole, is that good for society?

But you’re ignoring the fact that there are heaps of our lowest income people who don’t own cars but walk, bike, bus and train everywhere, and who are currently being forced to pay $3 a day through their rates to subsidise other people’s driving. Any congestion or fuel charge which reduces this subsidy is good for these low income people. You can’t say something is regressive just because it will disadvantage some poor people, when it will advantage a whole lot of other poorer people.

Either tax would potentially reduce that subsidy, but I still think CG is significantly more regressive than fuel tax for a lot of poorer people.

“In fact the sole purpose of the charge is to get you off the road and leave it free for rich people; you can’t get much more regressive than that” – very well put indeed!

I wonder if there are stats available to uncover the link between car dependency and income. My hunch is that car dependency is quite a lot higher for people on lower incomes – I know that when I’ve been poor I have had to drive a car to save costs. What would have helped me back then would be lower public transport fares, not imposing extra costs for having to drive.

None of the poorest people in society are car-dependent as they can’t afford cars. You have to have a level of wealth to get to the point of car-dependency.

I know there are studies showing that people riding buses have lower average incomes than those driving cars. I would expect the same with walking and biking (as they cost even less). Fuel tax is certainly regressive if you only consider car drivers, but when you consider all modes it seems to me like it should be progressive (taxing the wealthiest travel mode to help the poorer travel modes)

I’m not that convinced that AMETI and Airport Light Rail will allow that many poorer people out of their cars. Unless you are travelling to the city, the chance of both your origin and destination being close to decent PT in Auckland will still be very slim. I doubt that many poorer people work in the city. I guess a few might work at the airport.

Rapid transit is really for middle class commuters. Poorer people get priced out as house prices / rents near rapid transit stations are always excessive. And then we take away their direct bus and replace it with a transfer to rapid transit which is less convenient and takes longer.

In what world is an hourly ‘direct bus’ from Otara to the city centre more convenient or faster than a frequent bus to Papatoetoe Station and a frequent train to any destination on the Eastern or Southern line?

Depends on the frequency of the ‘rapid transit’, how rapid it really is, the chance of you getting a seat, your capacity to manage a more complex trip or know that it exists, your physical capability, whether you have a HOP card so you don’t have to pay to transfer, how far you are actually going (not everyone is going to the city), etc.

Its easy for us to sit here with our smart phones and HOP cards and say you can save 10 minutes of time by transferring, but I would say a lot of less capable people would much rather catch the hourly direct bus.

https://www.greaterauckland.org.nz/2016/11/02/riding-the-southern-new-network/

Looking at the old and new maps, how can anyone argue that the old network was *more* legible?

Yes however a lot of that simplification could be made without forcing transfers.

I do think the rapid transfer model is a better model, but I’m not convinced some of the rapid lines are actually that rapid (1 hr for 30km from Papakura to Auckland for example) or frequent, so a lot of the advantages are lost.

Firstly, it is widely suspected that fuel companies have been overcharging at the pump, and these suspicions have only been deepened by the lack of cooperation they have provided.

Secondly, a car is a luxury. I am not sure when it stopped being considered a nice to have, and became a necessity, but it is a luxury.

Thirdly, the public transport, cycling and walking infrastructure in Auckland is not adequate. In most of the rest of the country it is invisible, particularly public transport. The fuel tax is to target these inadequacies, and at the same time will make more people think a little harder about their transport options.

I try not to drive, and most regularly take the bus, with the good fortune of commuting between transport hubs. But not all car travel is due to lack of public transport solutions.

So as far as I am concerned, we should be paying for the luxury of a private vehicle, to subside improvements to our PT network. Coincidentally addressing carbon emissions in a small way at the same time. If they want to call the new petrol tax a carbon tax, just do it. If we don’t start taking climate change seriously we will soon have a tsunami to wash all our environmental sins away (and us of course)!

“I am not sure when it stopped being considered a nice to have” → that was when we started building cities in ways which require a car to get around.

This is especially apparent in Auckland. Streets are normally designed for a 100% car mode share. There are some afterthoughts for other things. There’s footpaths for those desperate cases when you have to park more than a few metres from your destination. But even then you had better be able to park on the same block, or else. If you take the bus, you may have to allow 5 minutes just to cross the street to the bus stop.

Auckland is still an extremely unpleasant place to get around without a car.

“with the good fortune of commuting between transport hubs” → so how is the property market around you?

Arguments over regressiveness are pretty much concern-trolling. Labour’s minimum wage and other benefit packages are looking after lower/middle income people just fine.

As is always the case, it’s the fact that the benefits of the tax and infrastructure spend aren’t immediate and often aren’t visible.

Funny to see Hosking so apoplectic too.

I don’t think it’s concern trolling at all. It’s a real problem with the method of raising revenue. There are better options, but they have other disadvantages (harder to collect being the main one) and will take a while to ramp up. Thus, it’s useful to highlight the problems and to define their extent. It’s quite a bit, mostly as the really big projects suck a large chunk of revenue raised, and thus some regions get taxed more per km (usually due to less efficient vehicles) and also receive less of the revenue raised (usually because they don’t need the mega projects).

The new Government will need to work hard to sell the benefits of the new GPS to the regions, by working hard to promote safety improvements and road renewals in those areas.

National took money from local roads in the regions and channeled it towards motorway projects in and on the edge of the countries five largest cities. I don’t think it will be too hard to sell the benefits to the regions.

Families yes, lower income people no. There is no tax relief for anyone who doesn’t get WFFTC other than the retention of the IETC.

That chart of fuel excise tax is, I guess, in cents per litre, which means it’s not inflation adjusted. It would be interesting to see an inflation adjusted version which I guess would make the longer term increases look lower, and provide a fairer view of what the real changes in excise tax have been.

Inflation adjusted, or percentage-of-fuel-price adjusted? Either way, that’s a graph I’d like to see too.

Fuel excise and road pricing don’t necessarily do the same thing either. ERP (Electronic Road Pricing or congestion charging) is used primarily as a traffic management tool such as in Singapore. In the Singapore example, some 20 – 30% of revenue is taken up by operating expenses. The rest is primarily spent on transit upgrades. ERP then doesn’t help the outer suburbs or towns / places without ERP. We really need a mix of both. Fuel excise is a blunt stick in terms of traffic management and effectively targets everyone that drives regardless of whether they travel at peak (which creates demand for expensive upgrades) or not (so a normal road suffices).

The context of this post is the fumbled announcement yesterday of what should have been great news. The set of policies was effectively what Greater Auckland has been advocating (perhaps why it was detailed rather than a working group or review) and what I think will greatly benefit Auckland and NZ as a whole.

Unfortunately, since the Prime Minister fumbled it, including the very disingenuous “not a new tax” statement, the changes to how we fund transport and prioritize transport has been missed. Now we have articles from Bernard Hickey stating this is a battle between a Rail Government and a Motorway Opposition https://www.newsroom.co.nz/@politics/2018/04/03/102251/a-rail-government-vs-a-motorway-opposition

I know people on this site vote a number of different ways and why I think people of all political persuasion can get behind the policies advocated here as they are based on facts and good argument more than just tribal politics. We can move past the car-centric policies of the past but given the last couple of days I am not as hopeful as I once was.

Someone had commented on the blog just the other day I think about making a nationwide increase to the fuel tax, which I think is generally good to help pay for all the regional transport improvements. The 2c increase idea might be good, but more incentives to use alternative transport & electric power is good. Flip our price we all paid a few years back was higher than if all the taxes were slapped on now. Was an interesting day in the news with that speed reduction report coming out on the same day, some motorists must of been fretting. Lowering open road speed would of course help save fuel at the same time. Three News had an article with a country person complaining they would get nothing & be paying for the “city folks” projects. Of course these people don’t realise how subsidised their rural roads are to start with, with them really getting paid for by the “city folk”. In July we will get increases to Working for Families Tax Credits & other benefits IIRC. We have just had a minimum wage increase (though long overdue) & also a year or two back the ACC component of vehicle registrations was greatly reduced so I suspect these & others are all pretty good in off-setting the regressive nature of the tax.

It isn’t just the 10-12c/L tax that the government is introducing, it’s on top of Auckland councils 10c/L and GST. That’s about 25c/L or $15 extra per 60L fill. This is significantly more than previous tax increases.

On the subject of RUC on EVs, logically it would be at the same rate as a diesel car. But what about plug in hybrids? And fuel efficient hybrids in general, as they’re not paying their fair share. Should all cars pay RUC?

Auckland Council’s increase is countered by a reduction in rates, with the interim transport levy being removed.

Does anyone have any evidence that poor people drive more? I would have thought it would be the other way around. There is nothing like discretionary income to encourage a long trip away at the weekend, or a group of six travelling in three different cars to the beach on Saturday.

“That’s about 25c/L or $15 extra per 60L fill. This is significantly more than previous tax increases.”

Yes it might be, but what other methods are there to both address climate change caused by increasing vehicle emissions,and congestion, other than to encourage people to drive less? Most people would agree that Auckland has a very adequate public transport system to enable people to get to the city by public transport. Despite this the number of people travelling to the city increases year by year and AT doesn’t seem able to reduce the car mode below 50%. So providing options to driving has not worked.

A voluntary appeal to drive less is not going to work.

One of the options to reduce car volumes might be carless days, but these are likely to be even less popular than a petrol levy increase judging by what happened in the 70’s.

If the alternative is to increase PT usage by stimulating demand by price reductions then that money has to come from somewhere. It is illogical to ask public transport users to pay -give us some money so that you can travel more cheaply?

Perhaps more and more we will see a greater cost for those who choose to drive. Jacinda Adern has said that her two top priorities are reducing child poverty and addressing climate change. In both instances neither of these objectives will be achieved by continuing to do the same things that we have always done. Driving less may be the new reality.

Remember too that Simon Bridges has said that National’s focus had to change to embrace the environment. (I suspect that comment was only for the purpose of gaining colleagues support for his leadership bid; or at best having those doing community service cleaning the beachfront at the Mount.) Even National might recognise that somewhere emissions have to reduce to achieve our international commitments.

Greetings I have just listened to a radio NZ interview with Matt Lowry about the fuel tax increases. One aspect that’s been avoided to be factored in is that the rise in Regional fuel tax and excise duty will increase the cost of everything we buy including food, and even public transport costs with exception of passenger rail that’s powered by electricity.

The common statement is the roads are congested and business cannot do it job of deliveries and meet time constraints which in turn means more trucks and drivers required to do the same amount of work due to congestion. The fuel tax will not necessary address this and I predict it wont make 1 bit of difference the motorist will just cough up and carry on as usual.

Until you recognise the real cause of congestion and not the symptoms your just fiddling in the wind.

So the short definition of congestion is : To many cars or specifically to many single occupant cars driven by lazy selfish entitled people at the expense of every one else and the expectation of others paying for there entitlements.

Another aspect that compromises the flow of traffic is the rapid and frequent lane changing that causes other drivers to brake and slow to avoid them causing an accident.

The fuel tax is not going to address the two above causes. But we need to look further at the current motorway system and local roads to see what can be done to better utilise what we have and to effect a behavioural change to move more people off the roads and into alternative transport systems.

What we need is a trial system in behavioural modification to create a long term solution. The post is already long but briefly we need to get priority for essential traffic and the rest will sort its self out or die trying. Bit of tough love in traffic.

Typical motorway of 3 or 4 lanes like Southern Western and Northern could allocate one lane just for trucks over 3.5 Tones and buses with passengers over 19 people.

The second motorway lane would take commercial trade utilities and deliveries and vans with 9 seats not single occupancy and registered Taxi vehicles for hire. Motorway lane 3 and 4 could be allocated to cars vans and Utes with single occupancy.

What would happen firstly the trucks and buses etc. would fly into the lead they don’t change lanes until the get off at exit lanes so wont slow traffic with constant lane changing creating a more of less free flow. The second lane will also flow better due to less traffic in the way.

There will be a need however for a number of enforcement individuals with instant fine devices to ensure people are in the correct lane at all times. Single occupant cars can be given free transport timetables and a voucher to catch discounted public transport for the first week as a gesture of good will while the learn to use public transport

Not necessarily, logistics companies spend more money on time (drivers, staff, fleet utilisation) than they do on fuel. A higher charge may suppress peak traffic somewhat, leading to faster turnarounds and cheaper deliveries.

In any case, that fuel is capital belonging to the world, including future generations. We are paying far too little for the privilege of burning it anyway. Righting that might put prices up, yes, and that might slow consumption rates. Equity questions are best addressed by taxing the corporate wealthy, not our children.

As if on cue

“EVs ‘not macho enough’ for some dads – survey”

― NZ Herald et. al.

Yeah right. Not sure what to even think of that.

How can we be sure the money raised will be used to improve congestion as opposed to ending up diverted to other areas as has happened with our current tax Surely if the money raised over all the years on petrol tax had been spent on our our roading infrastructure and not diverted to other areas then perhaps we wouldn’t be facing the dilemma we currently have. All I can see is council’s seeing another opportunity to rape and pillage their communities under the guise of if it’s not done then we could end up like Auckland. Government likes to crow about how modestly taxed we are yet if you add up how much the lower to middle income earners pay I would imagine it is at the higher end compared to the OECD average.

I agree with your sentiment about hoping the tax is used for the right purposes, to improve the transport situation. In terms of roading projects, I hope you’re not falling for the myth, though, that widening intersections and roads will alleviate congestion. That’s exactly what we’ve funded over the last 60 years, and that is why we’re facing the dilemma currently have. Adding road capacity adds traffic. What we need to spend the fuel tax money on – and indeed all our transport budget – is reducing road capacity, converting it to space-efficient and energy-efficient modes, and measures to encourage more people to adopt public transport and active modes. This will bring about reduced traffic volumes, more transport choice, better access, healthier people, and a less polluted environment.