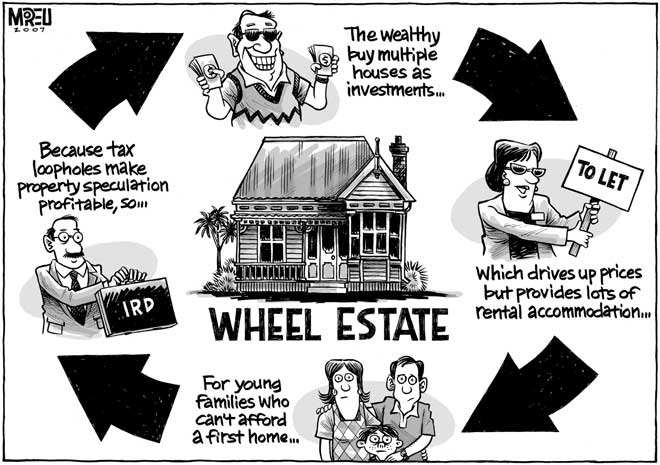

Like Jack Tame, I’m surprised by the slow update of apartment living in New Zealand. I am also bored by the degree to which “wheel estate” dominates the public discourse, which I suspect is symptomatic of wider policy issues.

No other country in which I have lived dedicates such a disproportionate amount of oxygen to the machinations of a single, relatively uninteresting market. Property seems to be the default topic of conversation, and default investment, for normal everyday people. This suggests that the returns to investment are too high relative to other potential investments, and by extension that a disproportionate amount of domestic capital will be invested in property. Notwithstanding the over-allocation of domestic capital,

This raises the question of how might we reduce demand for houses, without reducing the supply of housing itself. There see to be two areas where action might be required.

First, Auckland Council needs to drop many of the density controls which are inhibiting the supply of housing in central areas. The Unitary Plan contains a preponderance of absurd residential rules that are ultimately ill-suited to urban areas. Second, Central Government needs to change policy settings that seem likely to stimulate excessive demand for residential property. This includes domestic tax settings that seem likely to attract capital from both domestic and international investors.

Central Government has heaped blame on Auckland Council, without accepting that it also bears some responsibility for problems arising from excessive investment in property. The failure of Central Government to step up to the plate has seen it cop some deserved criticism.

In their defence, the Government earlier this year announced a number of measures designed to curb demand for residential property investment, most notably

- Redefining “intentions” – Whereas previously the onus was on the IRD to demonstrate that the people buying/selling properties were doing so for investment purposes, a new brightline test assumes residential property bought and sold within two years is investment and as such is subject to normal tax rates.

- Collecting information from international investors – The Government will now collect information from property investors who are tax residents in another country. This is designed to reduce opportunities for money laundering.

- Applying a new withholding tax to foreign investors – The Government also announced its intention to introduce a withholding tax on sales of property by non-resident investors. Few details on this withholding tax are currently available, although it is expected to come into effect in 2016.

- Increased funding for tax compliance measures – A further $29 million will be provided to the IRD for monitoring and enforcement to ensure compliance with tax obligations.

The Government’s announcements were announced hot on the heels of initiatives being implemented by the RBNZ, such as applying tighter loan-value restrictions (LVRs) on residential property investment in Auckland.

So what’s happened to property prices since these measures were announced? Well, they seem to have kept rising. That’s actually not very surprising, given that net migration continues to run hot, while the RBNZ has also decided to cut interest rates in response to falling prices for NZ exports and increasing volatility in global financial markets. Moreover, most of these measures have only been announced and have not yet taken effect.

One of the more interesting piece of information to emerge in recent months is discussed in this article, which reports analysis by MBIE. This shows Auckland’s housing market has followed similar trends to capital cities in Australia. This suggests two things. First, it reinforces the view that global factors are partly behind increased demand for property in New Zealand and Australia. Second, it suggests Australia’s recent efforts to restrict investment by foreign investors have not been particularly effective.

Should we expect the aforementioned changes to the tax treatment of property to dampen investor demand for houses?

Should we expect the aforementioned changes to the tax treatment of property to dampen investor demand for houses?

First, I want to emphasise that we probably don’t want measures to have too great an impact too quickly, i.e. we don’t want to manufacture a rapid slump in property values which threatens the stability of the wider economy. The better outcome, in my view, would be to implement policies that gradually reduce real house prices over a long period of time.

On the other hand, there’s a general consensus emerging that the Government’s changes are at the mild end of the response spectrum. To provide an example, the so-called “brightline test” for defining property investment applies only up to 2 years after the property is purchased. This is a relatively short time-frame, which seems likely to not capture many property transactions that are undertaken for investment purposes.

Back in 2010, Treasury provided the following advice to the Minister of Finance about the length of the brightline test (source):

“Any brightline period is inherently arbitrary. We consider a 5 year test would be the minimum that could apply before the advantages would outweigh the disadvantages. There is currently a 10 year brightline test that applies to property dealers and developers, so this period could be used as a precedent to apply to other real property sales such as residential investment property.” (page 2).

This Treasury memo also contained the following table , which summarises brightline tests which are applied in other jurisdictions. This highlights how the 2 year period proposed in New Zealand is relatively short.

On the “bright” side, the Government may argue that getting the “brightline test” adopted is a first step. Thereafter, the length of the test can be extended, as and when required to manage house price inflation. Beyond this, however, there’s not much more the Government can do given current policy levers. I guess the proposed withholding tax for non-resident property investors could be adjusted upwards if investment from those sources was found to be a problem, but it’s only addressing a small part of the demand curve.

So what’s the verdict?

Well, while the Government’s proposals are a step in the right direction, they are relatively timid and unlikely to have a meaningful impact on behaviour. Most notably, even with these policy changes, we will still be taxing property relatively lightly compared to other countries. I think there’s an argument to move much more strongly; there are some real macroeconomic risks in the global economy, e.g. Greece and China. Moreover, net migration to New Zealand is highly volatile, and could drop significantly from current levels if the global economic outlook improves.

My personal preference would be to implement a fiscally-neutral national land tax . This could be implemented gradually over time, e.g. start at a rate of 0.05% and increase it in 0.05% increments annually until house price inflation drops to reasonable levels. Revenue generated from such a tax could be used to reduce taxes elsewhere. Hence a land tax would be pitched as a tax shift, rather than a tax increase.

For now the Government seems focused on the progressing the measures it has announced. All I hope is that this represents the start of policy initiatives designed to address New Zealand’s hyper-active interest in property investment.

Processing...

Processing...

Land Tax would encourage efficient use of land, redevelopment of dilapidated land and investment in more apartments.

It could also replace other taxes.

Land Taxes support public transport because they (a) increase density, (b) recapture the value of large infrastructure projects such as rail projects, (c) provide a large and stable funding supply for large infrastructure projects.

Land Tax can do this while also allowing those taxed to choose how much tax they want to pay – if you don’t like paying so much you can move to an area where the land values are lower.

Land Tax video

Yes Land Tax, as opposed to what we have now which is a property tax (rates), is universally supported by informed and thoughtful analysts. See this summary:

https://agenda.weforum.org/2015/06/what-led-to-the-revival-of-the-worlds-cities/?utm_content=buffera4def&utm_medium=social&utm_source=twitter.com&utm_campaign=buffer

Prices keep rising because next to nothing is being done to address the underlying issues causing it because National like it the way it is. As experience shows, reforms by this government are generally an exercise of illusion riven with loop holes and out clauses, hang on to your house for 2 years and a day, its my only house in NZ etc etc. Christ any investor can see these so called “reforms” for what they are, that is they will do is leave the status quo as is, because on many fronts we’ve seen it all before.

Secondly migration may still be going up, witness the explosion in student visa numbers, but they are not buying houses albeit they need a roof over their heads. But again this is an area this government can control but they simply choose not to. Too many conflicting policies and students for example are a cheap exploitable group of labour to keep wages frozen!

A question I often hear when travelling is ‘ do we actually have to provide cheap housing in Auckland, why can’t we simply accept that for good or bad Auckland is now a mainstream international city and like all others simply is what it is, you can’t stop that evolution?’. I do wonder, maybe there is substance in that. Auckland and NZ are no longer global backwaters and maybe we need to accept that.

And I see the pseudo National MP for Epsom David Seymour is blaming the housing crisis on Auckland Council. If David wants to be taken even slightly seriously he would realise that AC is having to pick up the pieces from a mess made by his government. Picking up a lot of pieces unsupported I might add!

Try harder David, we aren’t all as thick as the rest of your colleagues think we are!

And Seymour was on RNZ this morning with the same tired, old talking point we have heard so many times before, ie. that high house prices are caused by Auckland Council refusing to expand the city limits into greenfield sites.

I do not understand why those who advocate for this seem to have no concept of a limit to outward growth. Opening up land around the city will only ease the housing shortage that we have right now. What do they think should be done in ten or twenty or thirty years as our population continues to expand? Exactly the same arguments will apply then as now.

Sooner or later we just have to stop and if not now then when?

But even more than that is the point that of outward expansion is allowed with no limits while intensification remains in its current highly restricted form, there is no way any future development will reflect the desires of Aucklanders. It is just just social engineering on a Houston/Atlanta/Indianapolis scale where people have no choice but to live further and further from the centre with little or no alternative to auto dependence.

How a person claiming to be libertarian can argue for this with a straight face is unbelievable. But then he does represent one of the most NIMBY intensive electorates in NZ where the residents want absolutely no change to happen at all.

He has sold out all his principles for some pretty minor baubles. MP of one electorate and leader of a rapidly declining political party that will disappear as soon as Epsom voters decide to vote for National again.

Go to the RUB of Auckland, find that on one side there is medium density housing development and on the other there are lifestyle blocks. Then cycle for another 1 – 2 hours past lifestyle block after lifestyle block. Then ask “When did Auckland stop?”.

Shouldn’t he be proposing that the entire of Epson be designated an Extra Special Housing Area, where the RMA doesn’t apply for the next 5 years.

Consider that every bubble eventually bursts. If the Chinese economy goes tits up, demand for house in Auckland will slow. My customers that have purchased new houses tell stories of the chinese buyers bidding at Auction. Posing as families they reveal their true hand when they turn up a multiple auctions and buy the houses on sale.

Kiwi buyers in particular first home buyers don’t get a look in. Consider the view from the Chinese investor. They can invest in the Auckland property market and make a good return tax free within two years. Why wouldn’t you? Be silly not too.

The reason John Key and his National cronies are impotent towards this issue as they have a vested interest. They all have investments in the Auckland property market. Clearly stopping Chinese investors will hurt John and his mates in their pockets. Nope no chance of that. Fat cats in Wellington just get fatter. Meanwhile ordinary kiwi’s are loosing out on the chance of buying a home in their own city.

The “pin” to the Auckland property bubble is the stalling of the Chinese economy, which is due to happen sometime in the next 12 months..

There’s a bit more to the Chinese equation – a lot of the bulk buying of Auckland property is simply dirty money laundering – which our government is only making token gestures towards rectifying in order to pacify/shut us up. If the Chinese/foreign ‘investors’ were removed from the scene house prices would not have risen so rapidly. But now the door is open we are simply seeing our prices (Auckland) start to match that of other major cities, where sadly, over time, only the wealthy can afford – and that is where we are heading. When they match (give or take a small %) then we will see a plateauing of prices – which is still some way off.

On the actual prices being paid for homes – none stack up as rental propositions – even with the kick backs the interest rates and costs on $1m plus homes mean these places are not being bought to rent – or an investor (do the sums on any bank website) would be looking at expecting $1100 a week upward in rent for very mediocre accommodation – which simply isn’t happening out there – majority of punters can’t / won’t pay that.

No taxes of any sort will make any difference to what is happening out there – just wishful thinking from those who aren’t on the bandwagon. Even countries with the most draconian land and property tax regimes are still seeing central / capital city price rises through the roof. The door has opened and the horse has well and truly bolted.

Welcome to Auckland – the most unlivable city for Kiwis, courtesy of our Council and our Government.

You forgot one key point Stu on why NZ’s fascination with housing above all else.

1987

Baby Boomers and other got extremely hurt by the crash back then and it sparked off what we see now today.

A reluctance to go back to things like the Sharemarket and thus see housing a safe bet and hedge compared to our overseas neighbours.

But NZ wasn’t the only country affected by the 1987 crash. Why haven’t other countries become as obsessed with property.

Actually I would say that almost all English speaking countries have an obsession with property, namely owning it. I have seen the same obsession in the UK and Australia but not so much in mainland Europe.

I was waiting for someone to raise that point Goosoid 😉

The answer to that is I couldnt tell you. But you are right in that English speaking Western Countries there is this obsession with private property where on mainland Europe their systems give advantage to you renting your home while penalising you for owning one.

Odd

It’s all about tax treatment relative to other investments. Property is, in effect, a tax free investment in New Zealand and taxed at a relatively low level in Australia and the UK.

Exactly. Plus I think very landlord friendly renting rules that discourage renting for families and so everyone wants to buy rather than invest.

There needs to be more certainty for tenants in their tenure as long as they pay their rent and are generally good tenants.

I really think Germany is a model we should be looking at. They have one of the lowest property ownership rates in Europe but a top performing economy.

Would you please elaborate on that assertion Bill? I own or have owned rental property (both residential and commercial), shares and other businesses and can’t see the slightest difference in tax treatment. All forms of investment result in taxable income (or loss), with capital gains untaxed to an investor but taxable to a speculator. Each form of investment has its risk profile, some are active, some are passive, but all are taxed in exactly the same way.

New Zealand’s lack of a capital gains tax is unusual in the developed world.

Property investment is Auckland is mainly about capital gains. Often the rental income is below the rate of return from conservative bank deposits see http://www.barfoot.co.nz/market-reports/2014/january/suburb-report. Meanwhile depending which figures you look at, the capital gains on Auckland property investment is better than 20 percent.

So most of the return on a property investment is untaxed – with today’s NZ Herald headline rate of a 26 percent return in the last year that means in 2015 85 percent of the return on an Auckland property investment is not taxed. I don’t know another asset class with similar numbers.

So Bill I take it you agree there’s no difference in tax treatment, just that the split between income and capital gain differs from some other forms of investment. I have two friends who invested in (different) IT start-ups; both have been successful and made millions (and good on them). Again, same tax treatment.

If you’re making a roundabout case for CGT then fine, but that would need to apply to all forms of investment and involve a total review of the tax regime. However, you’re right that yield from residential rents is poor, typically 3% net before tax or 2% after (commercial yields are better). Note that Barfoot’s gross yields are somewhat simplistic. Imagine the outcry from the renting group if yield was at a more realistic rate, coupled with a CGT. In reality rents are set by the market, not by the owner’s aspirations.

It’s true that a whole generation got badly burned in 1987, but I think part of the explanation for continuing reticence is the shallowness of our stock market. Of course we can, and should, spread our share investments overseas, but that adds a layer of complexity which limits those willing to play. Dodgy finance companies in recent years hasn’t exactly helped to restore confidence. That leaves real estate which at least you can see and touch, and is more or less permanent (natural disasters aside). Of course there’s a correction every ten years or so (1988, 1998, 2008) but that’s not an issue provided you’re not relying too heavily on debt finance.

Being priced out of the market is an issue still in San Francisco. Affordable housing initiatives haven’t worked and unlike Auckland – they have maximum density already.

http://thenextweb.com/insider/2015/07/11/san-francisco-housing-inflated-by-tech-money-is-in-trouble/

That could be true but San Francisco and Auckland aren’t analogous. San Francisco is more akin to the Auckland isthmus whereas with greater Auckland City being like the Bay Area. Other contiguous cities in the Bay Area don’t have quite the same housing problems the San Francisco peninsula does.

Yes they do. San Rafael, Berkeley, even South San Francisco are really expensive, even poor old Oakland. You have to get pretty far away to find a house that’s “affordable.” A lot of people commute as far as Modesto (2 hours) so they can own a house. It makes for a minimum 12 hour work day. Even then, many don’t even have enough furniture to have guests so they never invite people to visit. It’s really that bad. And let’s not even talk about San Jose/Silicon Valley.

Not sure about maximum density. NIMBYs seem to be stopping density there at least as much as in Auckland:

http://www.bizjournals.com/sanfrancisco/blog/real-estate/2015/03/california-soaring-housing-costs-sf-nimbys-crisis.html

http://www.economist.com/news/united-states/21591187-californias-new-technological-heartland-struggling-its-success-growing-pains

Arguments about what to do about the “housing crisis” seem to want to identify the one thing that will make all the difference. There is no one thing. Such a trend in a major market is always facilitated by a suite of factors, some of which can be influenced, others can’t. In the case of investment in housing, some of the money can be taken out of it through a capital gains tax. If it reduced short term return by, say 15%, housing will be far less attractive, especially to the quick buck investor. This is something easily done by legislation but suspect a National government isn’t interested. (Land tax has also been shown to be effective in promoting development.)

The proliferation of the auction is also has a large effect in bidding up housing prices because that is its sole purpose, and it works. I had a real estate agent brag to me that he got an extra $150,000 for his client in only 45 minutes. Of course, a bit of that went into his own pocket. He will also get more listings because of his effectiveness in bidding up prices, thus making the situation worse. I don’t know how that could be regulated.

There is also a lack of lower cost housing types, like modular housing, to bring competition to the new house market. I’m not talking about lower standards, just streamlining the construction process. (If that guy in China can build a 59 story building in 19 days, imaging how many 120 sqm houses can be banged out in a week.)

Of course, there is the problem of very high demand. Some of the air can be taken out by changing immigration rules. Still, people want to live in Auckland and that is something that we don’t want to change. How does Auckland compare to other high amenity first world cities re housing – Vancouver, London, San Francisco, Copenhagen. You certainly don’t hear about this problem in Dannevirke, Cleveland, Alice Springs, Harare, or Yellowknife.

I would like to know if any city with this problem has enacted measures that have actually worked to bring down housing costs. Haven’t heard of any but there are a lot of things I haven’t heard of. Maybe there’s some work out there we should reference.

I was driving through Ponsonby the other day and noticed that the floors above the retail seemed to be vacant. Around AKL there is the potential for thousands of units in these space, where the only cost is the fit out – not necessarily cheap but the building is there and the land is paid for. I know that cities all over the US, even the less desirable ones, have seen a lot of upper floor conversion to housing and it’s very popular with younger people. Why not here? It’s certainly a business opportunity.

Extending from that, we have to get over the stigma about renting. There is already far less of it than in the US. But the expectation that a family in their 20s, starting out in their careers, should be able to afford a house of their own is totally unrealistic unless entry level jobs these days pay six figure salaries.

And so it goes.

Good post Stevenz. While it will take a few things to change the housing market, one thing that most (but strangely not all) people seem to agree on is that there is little benefit to NZ from foreign property investment (especially from China). It would be relatively simple to ban this and provide an avenue for genuine investment for things like hotels etc through a local partner.

Based on the sales survey released on the weekend you would see 30% less buyers in the Auckland market by banning China based investors alone (let alone bans on other countries). This is a HUGE amount! At the very least I would imagine such a reduction would level the market if not result in a gradual drop. So long as a drop in house prices remained less than 10% per annum then over the space of 3 years we could have close to a 30% drop in house prices. Even 30% would mean they were still overpriced however with 3 years of inflation it does bring them back to a somewhat reasonable level ($700k back to under $500k).

It would indeed help, and a lot. This idea has been talked about but I wonder if it’s legal to limit investment from one country (discrimination!), or put special tax provisions on it. Then what to do if money is laundered through the Cayman Islands (as so much is). How will the Chinese stock market crash affect offshore investment? What would it say to the Chinese about doing business in NZ? (Frankly, I think nothing. They’ll go where they will make money. But that argument may come up.) But then there is NZ investment in China. etc etc. Regardless, ALL options need to be on the table and given due consideration.

As I understand it, nobody can buy land in China, whether they’re Chinese or foreigners.

I don’t think it would be right to ban only Chinese overseas buyers; if there was to be a ban on foreigners buying land in NZ (and I’m not advocating here that there should be), it would have to apply to all foreigners (and some way of tracing bogus NZ front people back to any foreign buyers would have to be enforced, e.g., via tracing bank transactions, etc.).

Foreigners cannot buy land in China.

The Chinese have wisely decided they don’t want foreigners coming in and messing up their property market to make a quick killing.

We are not as wise as they.

Banning Non Citizen Chinese from buying NZ property is racist. Banning all non citizens from buying Nz property is- eminently sensible.

In Australia overseas investors in housing are only allowed to purchase new housing stock. It works quite well, and some apartment buildings have been almost exclusively sold off-the-plan to Chinese investors, so it’s a great way to get new developments to the market. The only criticisms of the policy in the media are that the rule is not policed, there is no withholding tax in rental income, and that some of the buildings have low occupancy rates (ie investors holding the unit for their occasional trips to Australia).

Re the question of how what is still a relatively poor country (China) has so much to invest overseas. I have a family member who is a construction contractor in Indonesia. The standard kick-back on government contracts is 40%. In the old days these was delivered in brown paper bags, now it is through overseas accounts in Singapore. So 40% of the country’s development budget is sent offshore. To get a job in a section of the public works department that handles such contracts one needs to first pay a more senior person in the organisation, but once this is paid off there are rivers of hot cash. The next trick is to retire from such a position just before being found out, and to have an escape strategy that avoids being stripped of assets. So real estate in NZ or Aus form part of that strategy.

How do I get one of those jobs? Preferably without having to live in Indonesia.

We’re certainly not alone in the problems that stem from international money flows into property:

http://www.theguardian.com/money/2015/jul/13/canary-wharf-flats-maine-tower-overseas-buyers

I’m not sure I agree that the off plan sales to offshore buyers benefit a city – what good are buildings that are largely unoccupied, as many such sales are? That does nothing for market affordability, stability or utility.

Housing inflation is caused like any other inflation – more money relative to supply of goods. In New Zealand we have done that in a number of ways such as making housing far more attractive than any other asset. However, with general inflation low – and probably heading negative – asset inflation will be high as well. A few other things we have done that has not been mentioned here. The first is the Accommodation Supplement that was supposed to help the poorest but, as I have observed, mostly goes to the landlord. This is actually more than $1 billion a year and really it should be phased out. The second is the KIwisaver first home buyer scheme. All this has done has added fuel to the fire.

“My personal preference would be to implement a fiscally-neutral national land tax . This could be implemented gradually over time, e.g. start at a rate of 0.05% and increase it in 0.05% increments annually until house price inflation drops to reasonable levels. Revenue generated from such a tax could be used to reduce taxes elsewhere. Hence a land tax would be pitched as a tax shift, rather than a tax increase.”

Maori land ownership trusts are communal organisations with complex governing structures that can have difficulty initiating new development and the owners are almost always highly reluctant to sell. A tax shift to target land will impact groups with high land ownership and low rates of return on that land.

The Maori swing vote sits at the balance of power in NZ politics. Implementing a land tax is going to be difficult .

O.K. give them a tax break – but maybe not forever.

Agree; depending on the circumstances, and on the proviso of effective safeguards against abuse by non-Maori using Maori to claim the same tax treatment.

I love the idea of introducing a minimal tax which can be tweaked to meet policy needs. How about doing this with capital gains tax on investment property (that is not a primary residence). Start with a CGT rate of say 10% of the capital gain and push it up gently until the pips squeak.

I do have to question the trend to blame everything on overseas Chinese investors. We are only going by surnames, but we need to remember that the Chinese have been emigrating to NZ since the 1860s, which makes them longer termed citizens of our country than a lot of those with Anglo Saxon names.

We need a lot more information on where those “investors” come from before we can make informed decisions and not fly off the handle at a name that isn’t Anglo Saxon. For the record, my mother’s family emigrated to NZ in the 1860s, while my father emigrated here in 1927, both from Essex in England.

Of course (I don’t think anyone is suggesting that New Zealanders with Chinese ancestry would or should be classified as foreign investors/speculators – they’re obviously not).

In discussion of urban boundaries, a point rarely discussed as far as I can see is, ‘Is the urban boundary *in fact* constraining development?’

An urban boundary may validly exist to prevent poorly planned, unserviced leapfrog sprawl (in the original sense) outside it, while still keeping enough developable land to cater for current demand within it.

A developer may whinge because the boundary prevents them from making a motza on subdividing farmer Jones’s land outside the boundary; but that does not mean there’s a systemic problem until the land within the boundary is fully developed.

Is Auckland’s urban boundary actually constraining greenfields development?

Yeah, Nah. Yeah, Auckland’s RUB is constraining medium density housing developments. Nah, developers can still make a “motza” out of subdividing property outside of the boundary, dividing Farmer Jones’ land into lifestyle blocks.

Go to the RUB of Auckland, have a look. Rural sprawl for 30 – 50 km.

I invite everyone to go to the Barfoot & Thompson’s Auctions every Thursday morning at the Bruce Mason Centre in Takapuna. I’ve been to hundreds of auctions and I have my personal statistics.

What are the stats?

I went to an auction last week, of the first 7 houses, 5 were bought by Chinese who couldn’t speak any English. (Ie not Kiwi Chinese, fly in and buy Chinese).

5 of 7, I had no idea it was that bad…

Stu, do you mean slow uptake of apartments, rather than slow update?

“because tax loopholes make property speculation profitable”. Lucky the cartoonist is a cartoonist and not a property speculator – they’d be in jail for tax evasion.